Convert Sole Proprietorship to Private Limited Company

A proprietorship Company, sometimes known as a Sole Proprietorship Company, is a form of business owned by a single individual. There is no legal separation between the business owner and the private limited company. The owner has direct control over all areas of the firm, is responsible for its operation, and is solely responsible for its profits or losses.

A private limited company, abbreviated as LTD, is a privately owned business. A Private Limited Corporation restricts owner responsibility to its shares and has a maximum of 50 shareholders. It also prohibits stockholders from openly exchanging their shares.

Choosing Between a Proprietorship and a Private Limited Business

- A private limited company has a number of benefits over a single proprietorship. We’ve highlighted a few examples below:

- A single owner would be subject to limitless liability for any losses incurred, which implies he or she would be personally liable for any losses incurred by the business. A private limited company’s regulation distinguishes between the owner and the entity, limiting the owner’s liabilities.

- Sole proprietors will be taxed at their personal income tax rate, whereas a private limited corporation would not be. Learn more about the corporate income tax rate.

- Unlike a private limited corporation, sole proprietorship enterprises do not have appropriate fund-raising opportunities.

- The death of a single owner would result in the firm’s liquidation, while a private limited company allows the legal successors to legitimately take over the business’s responsibilities.

Differences Between a Sole Proprietorship and a Private Limited Company

| Particular | Proprietorship Firm | Private Limited Company |

| Registration | No Formal Registration | A Private Ltd Company is registered under Companies Act,2013 |

| Legal Entity Status | Does not hold any Separate Legal Entity. | Hold separate Legal entity under the Companies Act, 2013 |

| Transferability of Shares | Non Transferable | Shares can be transferred |

| Taxation | Owners Income Tax | Profits are taxed at 30% plus surcharges and cess as applicable |

| Compliance | Not Required | Annual Return, Annual Accounts required to be filed with the Registrar of Companies every year. |

Requirements for Conversion from a Sole Proprietorship to a Private Limited Company

- A takeover or sale agreement must be signed between the single owner and the firm.

- The Memorandum of Association (MOA) requires to contain the purpose “The taking over of a sole proprietorship”.

- The sole proprietorship’s assets and liabilities must be transferred to the corporation.

- The proprietor’s shareholding should not be less than 50% of the voting power, and it must be held for at least 5 years.

- Except for the amount of shares owned, the owner receives no further advantages, either directly or indirectly.

Starting the Process of Converting from a Proprietorship to a Private Limited Company

If the aforementioned requirements are satisfied, a sole proprietorship may be transformed. About the conversion procedure, the following steps must be taken by an entrepreneur in order for the proprietorship business to be transformed into a private company:

- Acquiring the single proprietor’s Digital Signature Certificate (DSC) and Director Identification Number (DIN) for the new director.

- Obtaining approval to name the firm, which must be requested in Form-1. Check the availability of business names by clicking here.

- Submit an application to the MCA for business incorporation.

- Finishing the slump sale procedures

- Changing the bank account information to reflect the conversion.

- Uploading all necessary paperwork and forms (covered separately).

Process for Converting a Proprietorship to a Private Limited Company

When the foregoing prerequisites are completed, the following processes are taken to convert a sole proprietorship to a corporation:

- The owner is responsible for completing the slump sale paperwork.

- All directors must receive a Director Identification Number (DIN) and a Digital Signature Certificate (DSC).

- The owner must fill out Form – 1 to request the availability of a name.

- Create the company’s Memorandum of Association (MOA) and Articles of Association (AOA), which outline the company’s objectives and policies.

- Submit an incorporation application to the Ministry of Corporate Affairs (MCA).

- Provide all necessary paperwork.

- Get your Certificate of Incorporation.

- Get a new PAN and TAN.

- Change the bank information to reflect the conversion.

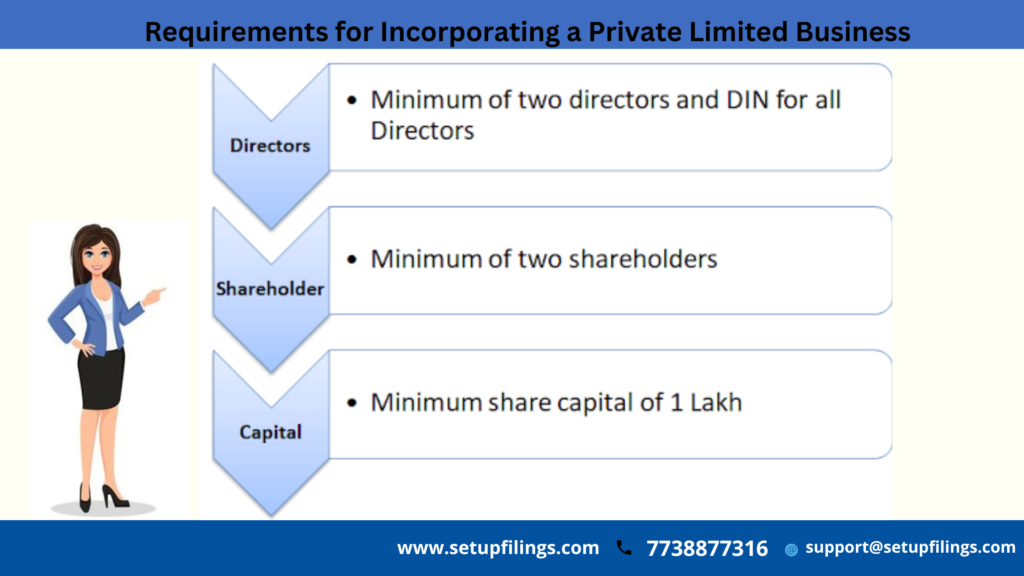

Establishing a Private Limited Corporation Requirements

The method for forming a private limited company from a sole proprietorship is to first incorporate the private limited company, then take over the sole proprietorship through a Memorandum Of Association (MoA) and transfer all advantages and liabilities to the limited business. As a result, before applying for a Private Limited or certificate of incorporation, the following prerequisites must be met.

1. Directors: A minimum of two directors are necessary for the foundation of a private limited company. One of them may be the owner, while the other could be any cousin or acquaintance.

2. Director Identification Number: As a condition of incorporation, the directors must obtain an Identity Number.

3. Shareholders: The corporation must have at least two shareholders, who might be the same as the directors. The single proprietorship’s owner must be one of the limited company’s directors.

4. Capital: The company’s authorized capital must be at least one lakh rupees.

The Advantages of Converting from a Sole Proprietorship to a Private Limited Company

1. Capital growth: A sole proprietorship’s capital is restricted to the owner’s money, but a private limited company has fundraising alternatives and may obtain more cash for expansion.

2. Limited liability: A lone owner is solely accountable for losses, and his or her personal assets may be taken to reimburse creditors in the event of a loss. In the case of a private limited corporation, however, such responsibilities are restricted by shares or a guarantee.

3. Continuity: Since a Visited 103 Times, 1 Visit today