GST Registration

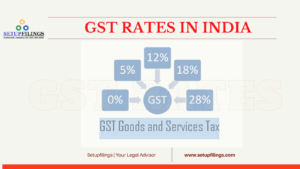

The Goods and Services Tax or GST is an tax which has replaced most of the indirect taxes in India like the VAT, excise duty, services tax, etc. the products and repair Tax Act came into effect on 1st July 2017. GST is levied on the availability of products and services. it’s a comprehensive, multi-stage, destination-based tax that’s levied on every value addition. The GST law is applicable all across India.

Packages

Choose your package & proceed to pay

| Basic | Standard | Premium |

|---|---|---|

| GST Registration | MSME | DSC Certificate |

| GST Registration | GST Registration | |

| MSME Registration | ||

| Rs.499 | Rs. 999 | Rs.3999 |

Gst Registration Online India

Overview

Under the GST regime, the tax is levied at every point of sale/value addition. within the case of intra-state sales, Central GST and State GST are charged on every sale whereas all the inter-state sales are chargeable to the Integrated GST tax Following taxpayers are required to be registered under GST:

- Businesses with turnover above the edge limit of Rs. 40 Lakhs (Rs. 10 Lakhs for North-Eastern States, J&K, Himachal Pradesh and Uttarakhand. For service providers, the limit is Rs. 20 Lakhs)

- Inter state suppliers

- Casual taxable person / Non-Resident taxable person

- Agents of a supplier & Input service distributor

- Those paying tax under the reverse charge mechanism

- Person who supplies via e-commerce aggregator

- Every e-commerce aggregator

- Person supplying online information and database access or retrieval services from an area outside India to an individual in India, aside from a registered taxable person.

How to get GST Number?

GST Number are often applied in a web process which needs multiple details of the business being registered. It requires various details regarding the business along side the subsequent documents:

-

Cancelled Cheque

-

Bank account (Name and address Details only)

-

Rent Agreement

-

Electricity Bill+ No objection Certificate (NOC)

-

Passport Size Photograph

-

Permanent Account Number (PAN)

Introducing Setup Filings, the ultimate solution for effortless GST registration online in India. No matter if you’re operating a private limited company or a partnership firm, we have all your needs covered. Our team of skilled professionals specializes in delivering a seamless experience for GST registration services, tailored specifically for private limited companies and partnership firms. Experience the convenience of our user-friendly online platform, where you can effortlessly complete your Pvt Ltd company registration and GST registration. Our meticulously designed process ensures full compliance with all the necessary requirements and regulations, granting you the freedom to concentrate on expanding your business. Rely on Setup Filings to handle your GST registration efficiently and effectively. Embark on your GST registration journey with us today!

Documents Checklist

Documents Required For Firm

PAN Card of the Partnership Firm

Partnership Deed

PAN card, Photograph and Aadhaar card of all Partners

Proof of appointment of authorized signatory- Letter of Authorization (Format are going to be provided by us)

Address proof of business

Own office

Rented office

Consented office

Bank details

Documents Required for personal Limited / Public limited / One person company / LLP

PAN Card of the corporate

Certificate of Incorporation / Registration Certificate of the corporate

PAN card, Photograph and Aadhaar card of all Directors

Proof of appointment of authorized signatory- Letter of Authorization (Format are going to be provided by us)

Address proof of business

Own office

Rented office

Consented office

Bank details

Documents Required For HUF

PAN card of HUF

Photograph, Pan Card and Aadhaar card of Karta

HUF Affidavit (Format are going to be provided by us)

Address proof of business

Own office

Rented office

Consented office

Bank details

Procedure for Incorporation

- Our executive will get in touch with you and will fill your GST Application form.

- Documents preparation.

- Fillings form with concern department.

- GSt certificate will send you by concerned department at your email-address.

Benefits

What are the advantages of GST Registration?

A. Easy and Minimum Compliances

One of the most important benefit of Limited liability partnership (LLP) Registration is Liability of each partnership into partnership firm extent up to his/her capital contribution only and it is totally opposite to sole proprietorship firm where the individual Assets or proprietor is always at risk.

B. Same Method or Procedure

Since the GST registration portal may be a single and therefore the same portal for all dealers in India, the tactic and therefore the procedure for a replacement dealer, tax payment or return filing becomes an equivalent providing ease to the dealers.

C. Decreases Burden of Tax

GST Online Registration has been proved to be helpful for reducing the tax burden on small scale industries by providing one tax everywhere the state.

D. Get Input decrease Dealers register under GST.

And here under the products and repair Taxit can claim the input decrease that already paid on purchases.

E. Scheme for little Traders

GST registration has provided a composition scheme for the convenience of small traders and businessmen. consistent with this scheme, The traders of small business are allowed to register and pay a really low and glued rate of tax to the govt which is usually fixed at 1-5% of their taxable turnover.

F. E-Commerce Business

GST certificate has given a serious benefit for the e-commerce website because without a GST number nobody can commence a web E-Commerce business. for instance Amazon, Flipkart, club factory Myntra, etc.

Process

Get the process done in 5 Easy Steps