08

Sep

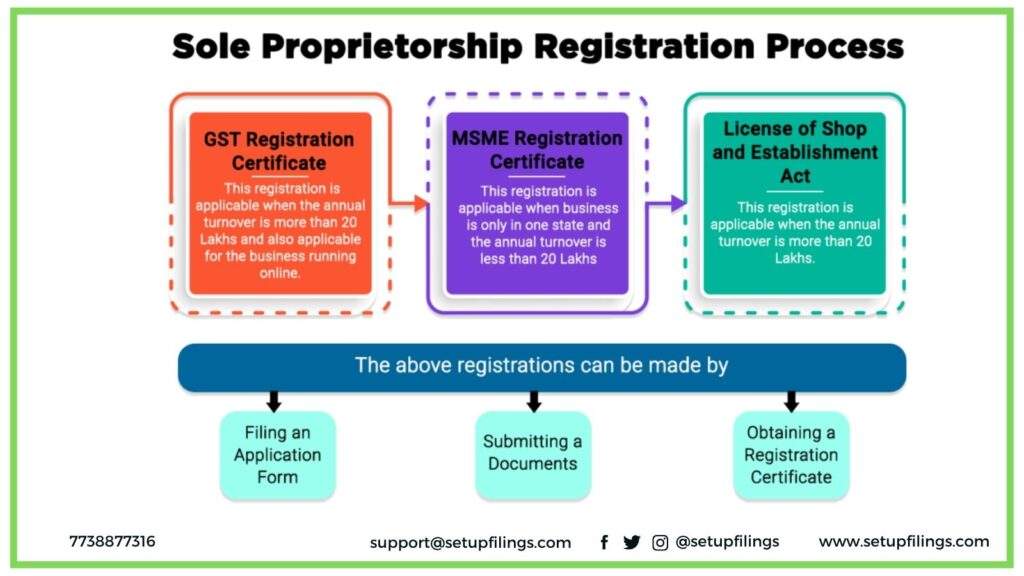

After GST (Goods and Services Tax) registration, there are several important things to remember to ensure compliance with the tax regulations and smooth operations.

Here are some key points to consider:

Display of GSTIN: Display your...