How Do I Download E-PAN Card Online?

The Income Tax Department in India assigns each individual a 10-digit unique alphanumeric identifier known as a Permanent Account Number (PAN). Individuals in India can use their PAN Card to conduct financial activities and pay taxes. This page discusses PAN Card download via the NSDL PAN site and the UTIITSL portal.

What exactly is an e-PAN?

The Income Tax Department is in charge of issuing e-PAN. It was recently implemented by the IT department in response to an increase in the number of persons requesting for a PAN Card. To first-time taxpayers, e-PAN provides an immediate allocation of a Permanent Account Number (PAN). Individuals who already have a PAN Card are not eligible to apply for an e-PAN. It is distributed for free and on a first-come, first-served basis. Furthermore, e-PAN is only accessible for a short time.

A resident of India is required to apply for an e-PAN. Furthermore, only individual taxpayers, not HUFs or organisations, can apply for an e-PAN. To apply for an e-PAN, you must already have an Aadhar Card that is connected to your registered cellphone number, and all of your Aadhar data must be correct. Most notably, someone who already has a PAN Card cannot apply for an e-PAN.

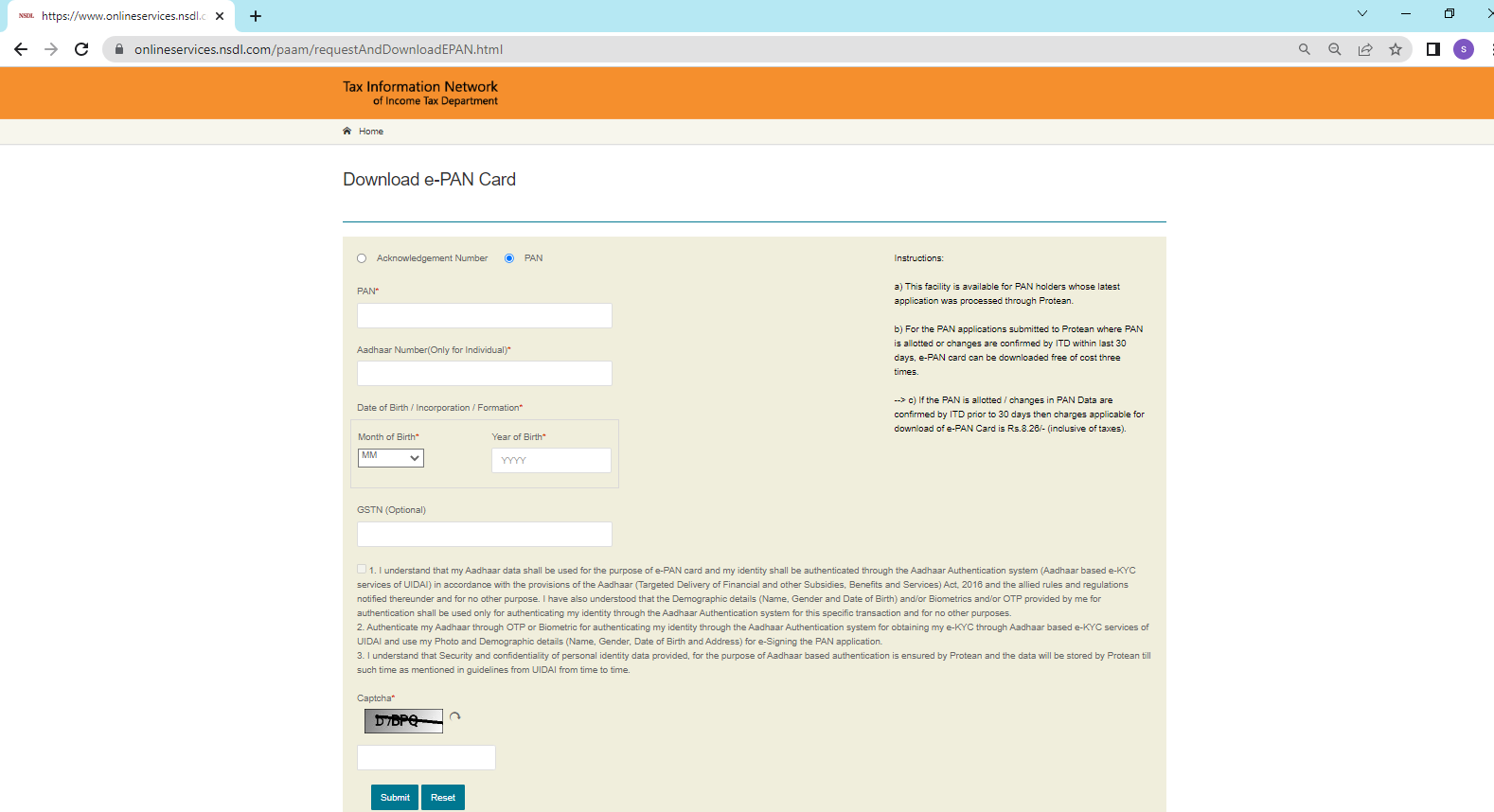

How Do I Get My e-PAN Card From the NSDL Portal?

The NSDL portal can be used officially Can be used to get an e-PAN Card. The NSDL web allows you to download a PAN card in two ways: with your PAN number and date of birth, or with your acknowledgment number.

Downloading an ePAN Card Using Your PAN and Date of Birth

You may obtain an e-PAN Card by entering your date of birth and PAN Card. The processes for downloading a PAN Card are as follows.

You may obtain an e-PAN Card by entering your date of birth and PAN Card. The processes for downloading a PAN Card are as follows.

- Step 1: Navigate Arrow to the NSDL PAN website.

- Step 2: Enter your PAN, Aadhar Card number, and date of birth in MM and YYYY format here. If available, provide the GSTIN number.

- Step 3: After reading the contents, tick the box, input the captcha code for verification, and click submit. You will be able to get a PAN Card in PDF format

Using the Acknowledgement Number, Download the e-PAN Card

The following are the processes for downloading a Pan Card from the NSDL website:

- Step 1: Navigate to the NSDL Pan interface and enter your acknowledgment number.

- Step 2: Enter the Acknowledgement number and your birth date in MM and YYYY format. Enter and submit the captcha code.

- Step 3: Enter your mobile number and email address, then click ‘Generate OTP’.

- Step 4: Next, input the OTP and click the ‘Validate’ button.

- Step 5: You will be able to download a PDF file. Click on it to obtain the PAN Card in PDF format. The e-PAN Card is a password-protected file, and the password is your date of birth in the format DDMMYYYYY.

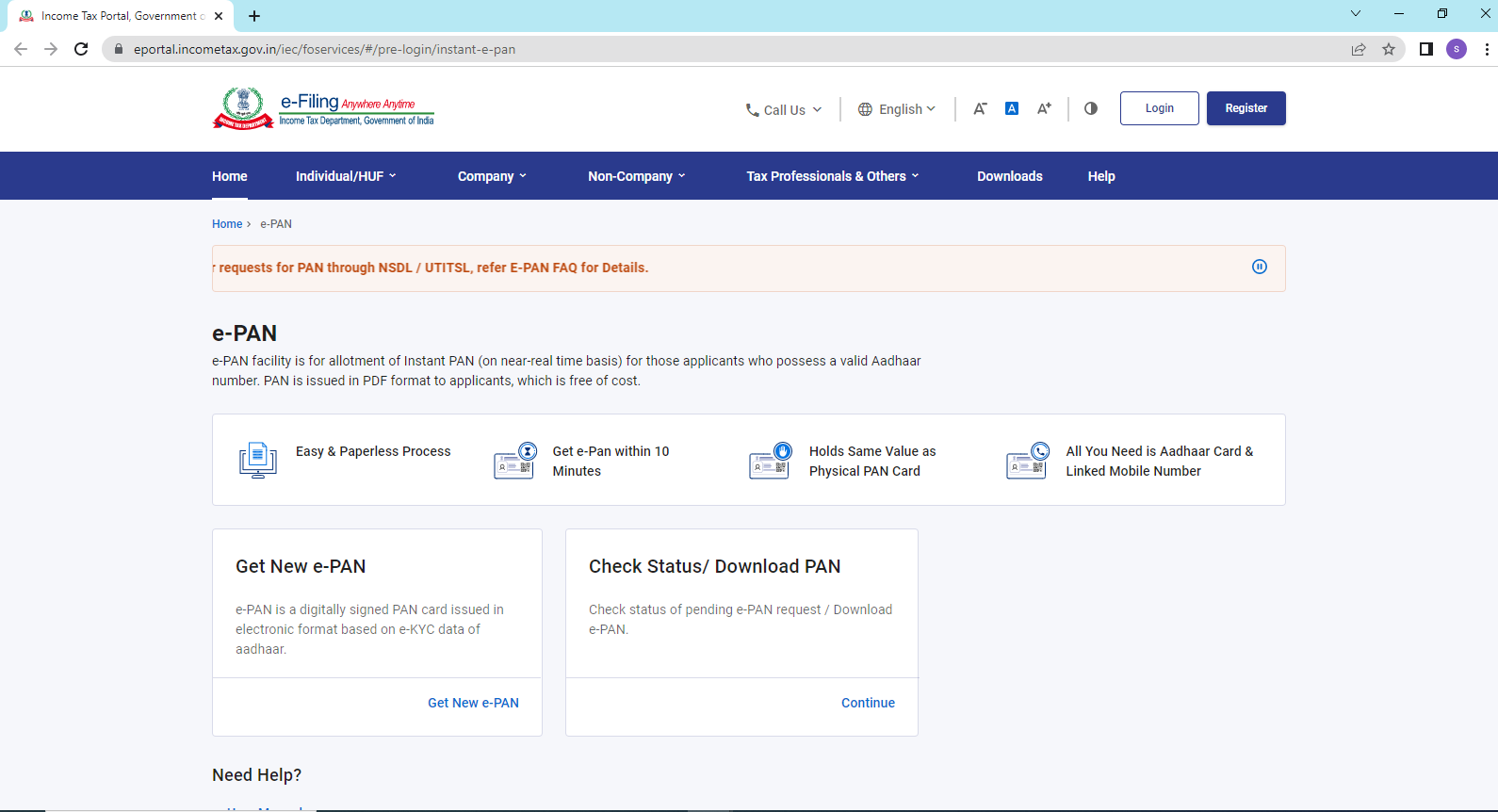

Downloading an e-PAN Card Using an Aadhaar Number

The Government of India has launched a facility that allows people to obtain their PAN quickly using their Aadhaar Card number. The entire procedure is paperless and paperless. To obtain a PAN card using their Aadhaar number, complete the procedures below:

- Step 1: Go to the Income Tax fo-portal website.

- Step 2: Select the ‘Instant e-PAN’ option from the ‘Quick Links’ area.

- Step 3: On the following screen, click the ‘Check Status/ Download PAN’ option.

- Step 4: Enter your Aadhaar number and captcha code to receive an OTP for authentication. Enter the OTP to confirm.

- Step 5: After successfully completing the verification process, the user may monitor the status and download their ePAN card.

You might also be interested in learning how to link your Pan card to your Aadhaar card.

Downloading an e-PAN Card from UTIITSL

- Step 1: Go to the UTIITSL site and click the ‘Download e-PAN’ button.

- Step 2: Enter the PAN Card number and date of birth in the ‘MM/YYYY’ format below. If available, provide the GSTIN number.

- Step 3: The registered mobile number and email address will be displayed on the next page. Check these details carefully, then select the OTP mode and click the ‘Generate OTP’ button.

- Step 4: Enter the OTP and complete the payment. After you have paid, you may download your e-PAN Card.

- Step 5: However, in order to apply for e-PAN via the UTIITSL website, one must have previously applied for a PAN or the most recent correct with UTIITSL. Alternatively, they must have a valid and active cell phone number registered with the IT Department.

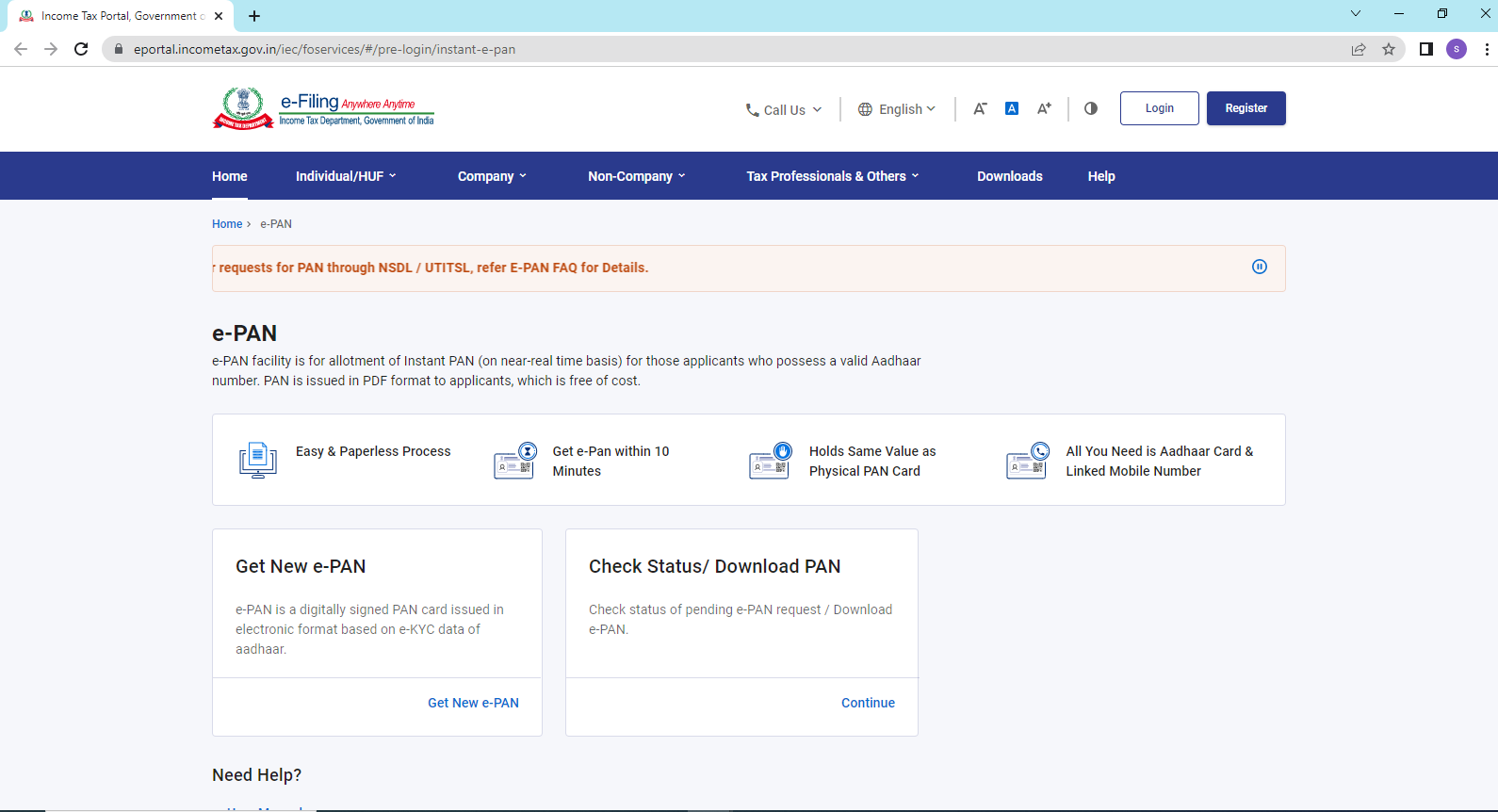

How Do I Get My e-PAN from the Income Tax Website?

In only a few steps, you may obtain your e-PAN via the income tax website. Before we go into the processes, you must have a valid Aadhar card number. The processes for downloading an e-PAN from the Income Tax website are as follows:

- Step 1: Go to the income tax e-filing website.

- Step 2: On the next screen, select proceed under the ‘Check Status/Download PAN’ option.

- Step 3: Enter your Aadhar number and press the ‘Continue’ button. The registered cell phone number will thereafter get an OTP.

- Step 4: Log in and enter the OTP.

- Step 5: View your e-PAN Request’s ‘Current Status’. If the e-PAN is active.

How to Get a Duplicate Pan?

The methods for downloading a duplicate PAN copy using your Aadhaar card from the NSDL website are as follows:

- Go to the NSDL website.

- Fill in the blanks with the following information:

- PAN number

- Aadhaar number

- Date of Birth

- Accept the statement and fill out the security Captcha.

- To proceed, click the ‘Submit’ button.

- Your PAN information may be found on the next page.

- Then, choose ‘Receive OTP on Email ID or Mobile Number’ and input the OTP.

- Select ‘Validate’ to obtain a duplicate copy of your PAN.

What Should I Do If I Have Multiple PANs?

If you have more than one PAN, you must fill out and submit the PAN Change Request form. On the application form, mention the PAN that you are presently using. All additional PAN numbers that were unintentionally assigned to you should be listed in item 11 of the form. Along with the form, the relevant PAN card copies must be supplied for cancellation.[/vc_column_text][/vc_column][/vc_row]

Visited 152 Times, 1 Visit today