FCRA Registration in India – Qualifications and Application

People nowadays are more concerned with social and environmental concerns. Businesses engage in actions that promote social, economic, cultural, and environmental development and prosperity in addition to their basic financial motive.

Today’s world is so interconnected and networked that travel to any region is straightforward. There are daily transactions between persons, localities, and nations. Thus, the flow of foreign money into and out of each nation is now normal and inevitable.

It is practically hard to regularly monitor the influx and outflow of foreign currency since the number of these transactions is so high. This compelled the 2010 Foreign Contribution Control Act to be passed.

The Objective of FCRA 2010

The Foreign Contribution Regulation Act of 2010 was enacted in order to:

• Regulate the acceptance and utilisation of foreign contribution or foreign hospitality by certain individual associations or companies; and

• Prohibit the acceptance and utilisation of foreign hospitality or foreign contribution for any activities unfavourable to the national interest, as well as matters related to or incidental to such activities.

Prerequisites for Eligibility

Standard Registration

A few prerequisites must be met to qualify for regular registration:

• The application must be registered in accordance with the Societies Registration Act of 1860 or the Indian Trusts Act of 1882, or as a Section 8 Company under the Companies Act of 2013 or any other relevant Act.

• Must have made significant contributions to society by participation in activities in its chosen area.

• Must have spent a minimum of Rs. 10,000,000 in the preceding three years to achieve its objectives (Excludes administrative expenditure).

• Provide copies of audited financial statements for the last three years.

• If a newly established entity intends to accept foreign contributions, it may submit a Prior Permission (PP) application to the Ministry of Home Affairs for a particular purpose, activity, and source.

Registration Requiring Prior Approval

Prior Approval is ideal for newly registered organisations that want to receive overseas donations. This is granted in return for getting a certain sum from a specific donor in order to carry out particular activities/projects.

• Be registered under the Societies Registration Act of 1860 or the Indian Trusts Act of 1882, as a Section 8 Company under the Companies Act of 2013 or any other relevant law.

• Provide to the Ministry of Home Affairs a specific letter of promise from the donor stating:

The monetary value of the gift.

• The rationale for its planned distribution

When the Indian receiving organisation and the overseas donor organisation share members, the following requirements must be met:

• It is prohibited for the Chief Functionary of the Indian organisation to be a member of the donor organisation.

• If the foreign contributor is a person, he cannot be the Chief Executive Officer of the Indian organisation.

• At least 51 % of the office bearers/members of the governing body of the beneficiary organisation shall not be family members or close relatives of the donor.

Application Method

To apply for registration under the FCRA, the following procedures must be taken:-

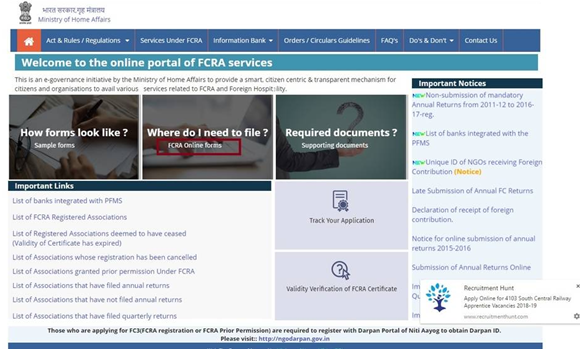

• The FCRA internet site must be accessed as the first step.

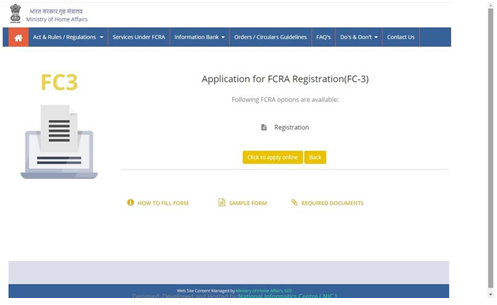

• Click on either Form FC – 3A (Application for FCRA Registration) or Form FC – 3B (Application for FCRA Prior Permission), as applicable.

• The website will then provide the customer with an online application option.

• After selecting “Apply Online,” the next step is to establish a username and password by clicking “Sign Up.”

• After a username and password have been generated and the corresponding message has been shown, the applicant may log in to the account.

•Upon signed in, the “I am applying for” dropdown menu must be used to choose “FCRA Registration.” After the selection of “Apply Online,” “Proceed Registration” must be chosen.

• Next, in the title bar, choose the FC-3 option to begin the new registration process.

• This is followed by the association form, in which the applicant must enter the pertinent information and attach the following documents: – Darpan ID (optional) – Association Address – Registration Number – Registration Date – Nature of the Association – Primary Objective of the Association After these fields and attachments are filled out, the submit button is chosen.

• Next, pick the Executive Committee option from the menu bar. The data will be included into the form for the Executive Committee.

• The “Add details of Important Functionary” option allows the applicant to add/delete/edit the information submitted for the Executive Committee.

• After entering all Executive Committee information, the “Save” button must be pressed.

• Moreover, bank information must be given, including the bank’s name, account number, IFSC code, and address.

• After entering the bank information, all needed papers must be submitted in PDF format.

• After the entry of the location and date, the final submission button may be chosen.

•The last step is to complete the online payment by clicking the button shown. After the money has been paid and the form has been submitted, the form cannot be modified.

The FCRA registration is valid for five years after it has been obtained. Note, however, that an application for renewal of FCRA registration must be submitted six months prior to the expiration date.

Section 6(1) of the Foreign Gift Regulation Act, 2010 requires any trust, organisation, or Section 8 charity that receives a foreign gift or donation to register. This kind of registration is known as an FCRA registration since the Foreign Contribution Regulation Act of 2010 requires it. The FCRA is the Foreign Contribution Regulation Act, and the registration processes in India are detailed here.

Importance of the Fair Credit Reporting Act of 2010

The 2010 Foreign Contribution Control Act was enacted in order to accomplish the following goals:

• Organizations may no longer receive unlimited foreign money or enjoy hospitality from foreign governments.

The Eligibility Conditions

• Standard Registration Process

• Standard registration requires that candidates meet specific requirements.

• An application must meet the requirements of the law, which may require registration as a Section 8 company under the Companies Act of 2013 or as a society under the Societies Registration Act of 1860 or the Indian Trusts Act of 1882.

• Must have had a major global effect by doing unique things in its area.

• Successful candidates must have invested at least Rs—10,000,000 during the preceding three years (Excludes administrative expenditure).

• Applicants must provide copies of audited financial statements produced by competent Chartered Accountants for the last three years.

• A newly incorporated organisation may get clearance from the Ministry of Home Affairs to accept foreign contributions for a specified purpose, activity, and source via a procedure known as Prior Approval (PP).

Mandatory Prior Authorization and Documentation

The Prior Approval method is the greatest option for a newly founded organisation seeking to collect foreign contributions. This is awarded when a specified number of funds have been obtained from a certain individual or group in order to complete a project or sequence of activities. The members of the group should –

• Hold a valid registration under the Companies Act of 2013, the Indian Trusts Act of 1882, the Societies Registration Act of 1860, or other applicable law.

• Submit a letter to the Ministry of Home Affairs detailing the donor’s specific pledges, including but not limited to:

• Amount of Contribution

• Purpose of the proposed allocation

• Members of a foreign donor organisation and an Indian beneficiary group may cross the border in this case.

• The organization’s most substantial contributor can’t simultaneously hire the head of the Indian nonprofit.

• According to Indian legislation, if a foreign organisation supports an Indian recipient, at least 51 percent of the recipient’s governing body cannot be comprised of employees or members of the foreign donor.

• If that’s what the Indians want from their leader, he’s not the right guy for the position if he’s a foreign contributor.

• More than half of the board of directors cannot be the donor or the donor’s immediate relatives or business associates.

Instructions for FCRA Registration

Form FC-3 is used to apply for FCRA registration by an individual. For your application to be complete, please provide the following:

• Copies of the association’s governing papers, such as a certificate of incorporation or trust deed, that have been certified by the association’s governing board.

• The association’s officials have testified to a copy of the Articles of Incorporation or Memorandum of Association, highlighting the areas that outline the association’s objectives.

• Report on Recent Activities, detailing accomplishments from the past three years;

• Statements of Assets and Liabilities, Payments and Receipts, Income and Expenditures, where appropriate, for the most recent three years that have been audited and that clearly show money spent on the association’s stated goals and administrative costs; \s

• After receiving an FCRA registration number, businesses have five years to comply with the law. FCRA registration may be renewed up to six months prior to the expiry date.

FCRA Registration Forms Online

Find out how to register online with the FCRA.

• As a first step, visit the FCRA website.

• Choose the “FCRA Online Forms” option to register with the FCRA.

• Complete your FCRA registration by clicking the link on the next page. Use the link to go to the subsequent page.

• To submit an application for FC3, click the “Online Application” link.

• Complete the required information and click “Save”

• If you’ve followed the steps properly, you’ll see a notification that reads “User ID successfully formed, and Your user ID is:” at the conclusion of the seventh stage.

• Username and password are required to access the site.

• After logging in, choose “FCRA registration” from the “I am applying for” option. To view our online application, click the link below.

• Choose “Proceed to New Registration” from the menu.

• Register for the event by selecting the FC3 Menu from the main menu.

• Darpan, I.D.

• Group’s mailing address

• The identification number for documentation

• Registration Location

• Registration Period

• Type of Established Bonds

• The Association’s Primary Objective

• Click the “Submit” button to submit the form.

Executive Committee Form

•To access the Executive Committee Form, click Executive Committee from the main menu.

•To modify the profile of the Executive Committee, click “Add information of Important Functionary.”

• After selecting the boxes next to the records you want to modify, click the Add/View button

• Complete the next screen with information about the foreign passenger. To make changes or remove a record, choose the corresponding option from the menu

•You must provide your EC information and other personal information.

•After completing the EC form, press the save button.

Financial Numbers

• Insert your banking details (account number, IFSC code, and complete address).

• Complete the form by selecting “Additional Details” from the drop-down menu.

• You will be required to submit your files.

Final Submission

• Choose “final submission” from the menu bar. To complete the application procedure, you must declare your purpose, choose the preferred time and location, and submit the form.

•Choose OK in the confirmation box to finish the submission

• Please note that after an application has been submitted, the information provided cannot be changed.

• To complete the purchase, choose “Online Payment” from the main men

• On the new screen, choose the Proceed for Payment option. To make a payment, pick your chosen payment option and checkout.

FCRA Registration Renewal

After getting an FCRA registration number, firms have five years to comply with the legislation. FCRA registration may be renewed up to six months prior to the expiry date.

• To begin, visit the Application for Renewal of FCRA Registration via the FCRA Online Forms website.

• Log in with your credentials to the FCRA site.

• To finish the application, pick “FCRA renewal” from the drop-down selection labelled “I am applying for.” To maintain your FCRA registration, perform the actions outlined above.

Visited 174 Times, 1 Visit today