Process to Register in Professional Tax Enrollment Certificate and for Professional Tax Registration Certificate in Maharashtra

All Business & Professionals who are registered in GST in Maharashtra as a taxpayers have started to admit Notice and Suggestion to Register and pay Professional Tax as per Professional Tax Act applicable in Maharashtra. Lately Maharashtra Government has changed the law and made it applicable to Limited Liability Partnership and Partners as well

What’s PTEC and PTRC?

PTEC stands for Professional Tax Enrollment Certificate and PTRC stands for Professional Tax Registration Certificate. Generally these Registrations are needed to conduct business in Maharashtra and in numerous other Countries. PTEC allows to pay professional duty of a business reality and also of the professional or proprietor of the business. In other words, PTEC allows the company to pay the companies and their director’s professional duty, also in case of existent like professionals and sole owner ( handed he doesn’t have any workers) all have to register under PTEC.

On the other hand PTRC allows the employer to abate and deposit professionals tax from the payment of its workers and deposit it to government. Both PTEC and PTRC are needed by a regular company to pay its own professional duty, as well as the professional duty for all its workers as is applicable. But, in case the Company and LLP doesn’t have any outstanding hand also it’ll only bear to pay PTEC and not PTRC and pay for Directors and Mates

Connection of PTEC and PTRC

Applicability of PTEC Every person who’s engaged in any profession ( business or service) banning that of Partnership establishment or HUF is liable to pay a professional duty of Rs./- sire with the government every time after the objectification or inception of the business. (LLP and All Companies are covered)

Connection of PTRC This instrument is to be gained by every person who’s liable to abate professional duty of any hand whose yearly payment is above Rs./-in Maharashtra

. The Certificate of PTEC or PTRC is to be applied by a person within Thirty days from the date he’s liable to pay Professional duty.

Following is the stepwise Registration process for PTEC and PTRC

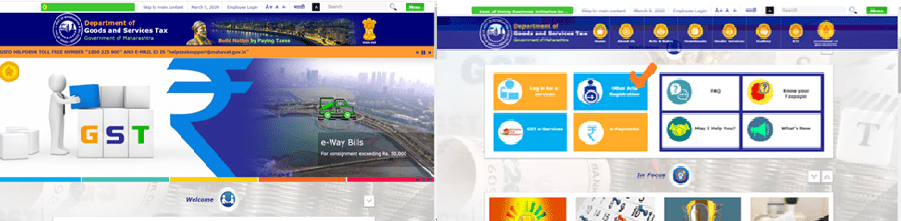

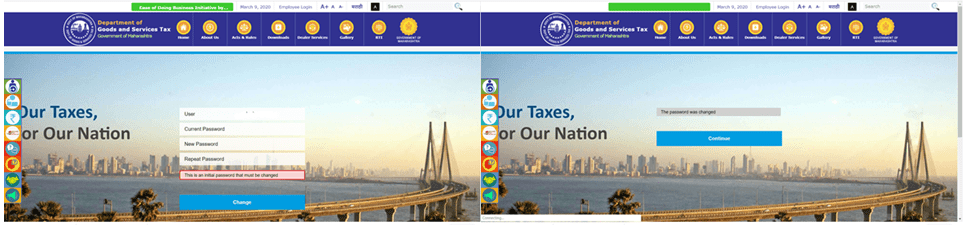

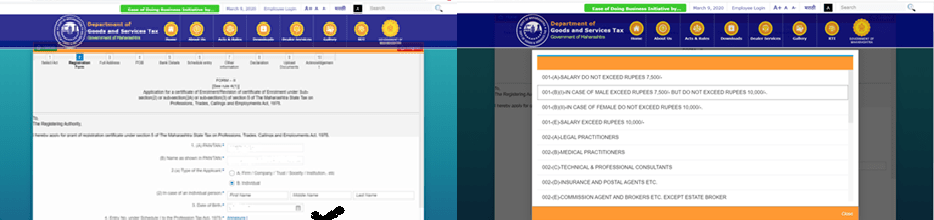

- Login to web pointwww.mahagst.gov.in – Select other acts and Registration

The screen below will appear

Select new registration under various acts and then select PTRC AND PTEC

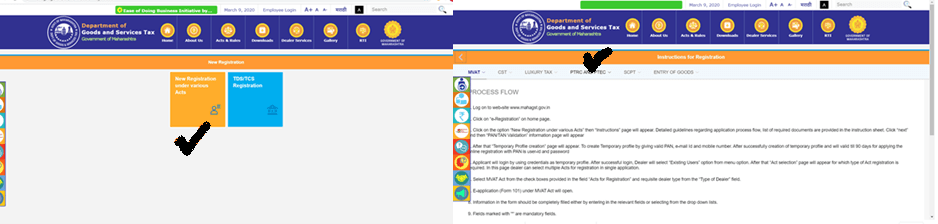

Select process flow and select next

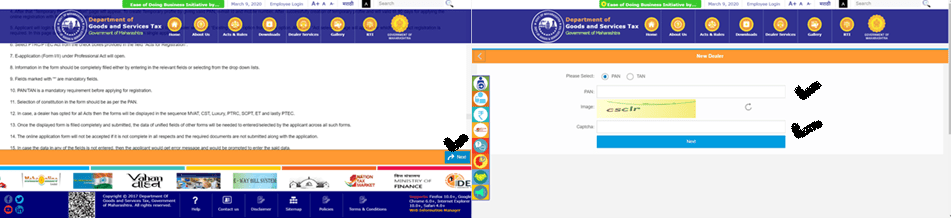

Select New dealer – Select Next- Enter PAN and captcha

- Enter dispatch and mobile on which you’ll admit otp and later you’ll admit a temporary login and word o the correspondence which you give

After which you have to login by opting e- payments- later login screen will appear

step-wise-process-to-register-in-ptec-and-ptrc-in-maharashtra_5

Select change password and enter current temporary password received in mail and also the new password you wish to keep

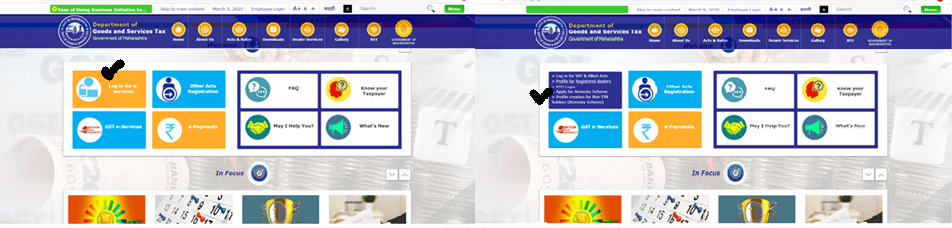

Select login for e-service tab – Select login for vat and allied acts

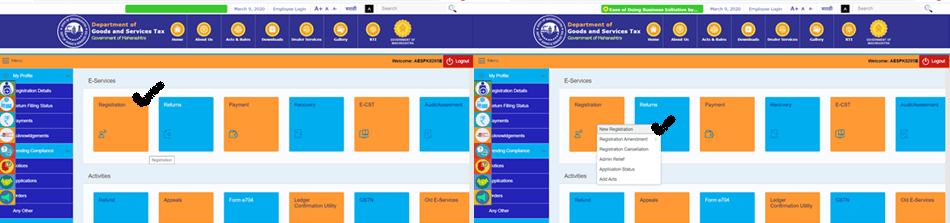

Select registration tab – Select new registration

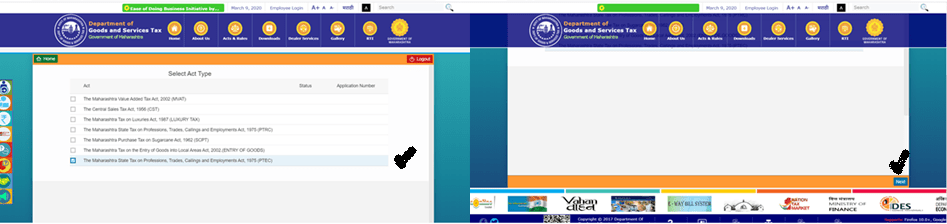

Elect the applicable act (PTEC/ PTRC) – Select coming

(Note: Then we’re opting the PTEC act, if PTRC is applicable to your company you can elect as is applicable)

step-wise-process-to-register-in-ptec-and-ptrc-in-maharashtra_9

Tabs will appear- For annexure you can select from 50 options given below

Following is the list of 50 Individualities and reality out of which one is to be named for Annexure as is applicable

- 001- (A)- Payment DO NOT EXCEED RUPEES/-

- 2. 001- (B) (I)-IN CASE OF Manly EXCEED RUPEES/-BUT DO NOT EXCEED RUPEES/-

- 001- (B) (II)-IN CASE OF Womanish DO NOT EXCEED RUPEES/-

- 001- (E)- Payment EXCEED RUPEES/-

- 002- (A)-LEGAL Interpreters002- (B)-MEDICAL Interpreters

- 002- (C)-Specialized & PROFESSIONAL Advisers

- 002- (D)-INSURANCE AND POSTAL AGENTSETC.

- 002- (E)-COMMISSION AGENT AND BROKERS ETC. EXCEPT ESTATE BROKER

- 002- (F)-CONTRACTORS EXCEPT BUILDING CONTRACTOR

- 002- (G)-DIAMOND DRESSERS AND POLISHERS

- 003- (A)- MEMBERS OF ASSOCIATION Honored UNDER THE FORWARD CONTRACT ( REGULATION ACT),

- . 003- (B) (I)- MEMBER OF STOCK EXCHANGE

- 003- (B) (II)-REMISIERS RECONGNISED In THE STOCK EXCHANGE

- 004- (A)-BUILDING CONTRACTORS

- 004- (B)-ESTATE AGENTS, BROKERS, PLUMBERS

- 005 – DIRECTORS OF COMPANIES

- 006- (A)- Certified BOOK MAKERS AND Coaches

- 006- (B)- Certified JOCKEYS

- 007- (A)- Pens, LYRICISTS, DIRECTORS, ACTORS AND ACTRESSES ( Banning Inferior ARTISTS), MUSICIANS, PLAYBACK

- 007- (B)-Inferior ARTISTS, PRODUCTION MANAGERS, ASSISTANT, DIRECTORS, ASSISTANT RECORDISTS, ASSISTANT EDITOR

- 008- (I)-MVAT OR CST DEALERS HAVING PREVIOUSYEAR?S ANNUALT.O. EQUAL TO OR LESS THANRS. 25 LAKH

- 008- (II)-MVAT OR CST DEALERS HAVING PREVIOUSYEAR?S ANNUALT.O.EXCEEDINGRS. 25 LAKH

- 009 – OCCUPIERS OF Manufactories NOT COVERED In ENTRY 8 ABOVE

- 010- (1) (A) (A)- SHOP & ESTABLISHMENT EMPLOYERS COVERED In THEB.S. &E. ACT HAVING NO Hand

- 010- (1) (A) (B)- SHOP & ESTABLISHMENT EMPLOYERS COVERED In THEB.S. &E. ACT HAVING Workers NOT EXCEEDING TWO

- 010- (1) (A) (C)- SHOP & ESTABLISHMENT EMPLOYERS COVERED In THEB.S. &E. ACT HAVING Workers EXCEEDING TWO

- 010- (1) (B) (A)- SHOP & ESTABLISHMENT EMPLOYERS NOT COVERED In THEB.S. &E. ACT HAVING NO Hand

- 010- (1) (B) (B)- SHOP & ESTABLISHMENT EMPLOYERS NOT COVERED In THEB.S. &E. ACT HAVING Workers NOT EXCEEDING TWO

- 010- (1) (B) (C)- SHOP & ESTABLISHMENT EMPLOYERS NOT COVERED In THEB.S. &E. ACT HAVING Workers EXCEEDING TWO

- 010 – 2-PERSONS OWNING/ Handling STD/ ISD Cells OR CYBER CAFES EXCEPT GOVERNMENT OR PHYSICALLY Hindered PERSONS

- 010 – 3- Operators OF Videotape OR AUDIO PARLOURS, Videotape OR AUDIO Mail LIBRARIES, Videotape GAME PARLOURS

- 010 – 4- String Drivers, FILM DISTRIBUTORS

- 010 – 5-PERSONS OWING/ Handling MARRIAGE HALLS, CONFERENCE HALLS, BEAUTY PARLOURS, HEALTH CENTERS, POOL PARLOURS

- 010 – 6-PERSONS Handling/ CONDUCTING COACHING CLASSES OF ALL TYPE

- 011 – Possessors OR Lodgers OF PETROL/ DIESEL/ OIL PUMPS, SERVICE STATIONS, GARAGES AND AUTOMOBILE Shops

- 012 – LICENSED FOREIGN LIQUOR Merchandisers AND EMPLOYERS OF RESIDENTIAL Hospices AND THEATRES AS DEFINED IN THEB.S. &E. ACT

- 013- (A)-PERMIT HOLDERS FOR EACH THREE WHEELER GOODS VEHICLE

- 013- (B)-PERMIT HOLDERS FOR EACH Hack OR PASSENGER Auto

- 013- (C)- (I)-PERMIT HOLDERS FOR EACH GOODS VEHICLES NOT COVERED In SUBENTRY (A)

- 013- (C) (II)-PERMIT HOLDERS FOR EACH Machine OR TRUCK

- 014 – LICENSED Plutocrat LENDERS

- 015 – Individualities OR INSTITUTIONS CONDUCTING Virgin Finances

- 016- (I)- STATE Position United SOCIETIES

- 016- (II)-United SUGAR Manufactories AND SPINNING Manufactories

- 016- (III)- Quarter Position United SOCIETIES

- 016- (IV)-HANDLOOM Needlewomen United SOCIETIES

- 016- (V)-OTHER United SOCIETIES

- 017 – BANKING COMPANIES

- 018 — COMPANIES

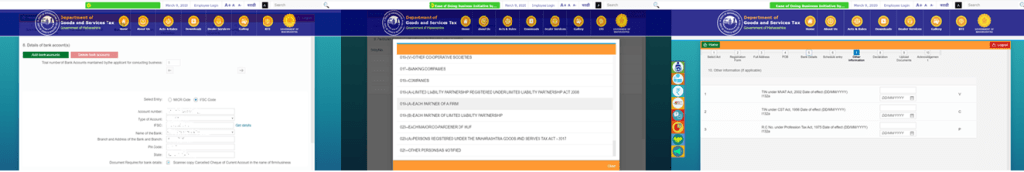

- 018- (A)-LIMITED LIABILITY PARTNERSHIP REGISTERED UNDER LIMITED LIABILITY PARTNERSHIP ACT 2008

- 019- (A)-EACH Mate OF A Establishment

- 019- (B)-EACH Mate OF LIMITED LIABILITY PARTNERSHIP

- 020 – EACH MAJORCO-PARCENER OF HUF

- 020- (A)-PERSONS REGISTERED UNDER THE MAHARASHTRA GOODS AND SERIVES Duty ACT-2017

- 021-OTHER PERSONS AS NOTIFIED

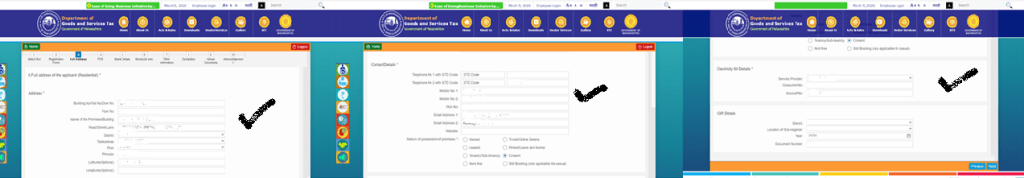

- After the Registration Form you have to enter your Address details – Dispatch & Contact Details (If dispatch and contact is used before it can not be used again) – Electricity Bill Details

After which you’re to enter the Place of Business (POB) details – Dispatch & Contact Details (If dispatch and contact is used before it can not be used again) – Electricity Bill Details

- After which you’re to enter your Bank Details after which enter your schedule entry as per the Annexure Named and later which a screen of other information will appear select as applicable

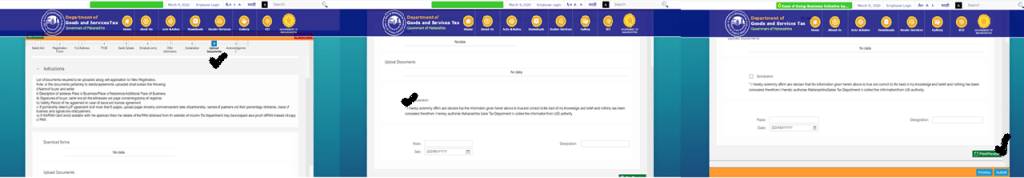

After which a Protestation runner will appear, TICK the box and do to Next and later the Upload Documents runner will appear. ( Note for PTEC no documents are needed to be uploaded-Tick the Declaration Box and enter the Designation and Place- Click on Publish Preview

Download Publish Preview and save the same in separate brochure-Select Submit later- Later Submission download acknowledgement and save the same. An operation reference number will reflect in the acknowledgment.

The online operation form won’t be accepted if it isn’t complete in all felicitations and the needed documents aren’t submitted along with the operation. In case any of the fields in the data isn’t entered, also the aspirant will get the error communication and will be urged to enter the said data. All communication will be made on the dispatch id and mobile given in the temporary profile.

After filing the operation form, click on the “ Submit” button. After successful submission of the form, an acknowledgment bearing “ Operation Reference Number” will be available for download on the evidence runner. The submitted operation form which will be communicated via e-mail as attached PDF Format.

The MSTD gate will carry out primary verification/ confirmation, including real- time Pan confirmation with NSDL portal, Aadhaar No. Confirmation with UIDAI portal, IGR details with IGR portal and affiliated service providers with Electricity bill serviceability similar as Tata Power, MSEB, Stylish, Reliance Energy and Toronto and allocation of Drum through MSTD department before submission of operation form

. The Maharashtra State Tax on Professions, Trades, Callings and Employments Act, 1975 Rules, announcements, forms and trade leaflets issued by the department are available on the sanctioned web point of the department http//www.mahagst.gov.in.

Entitlement of Registration Certificate

- If the operation is correct and complete in all respect along with applicable documents also the Registration Authority will induce Drum after verification. In this case the operation is eligible for granting Registration, also the date of uploading the operation is considered as determining the purpose of the operation for the date of the effective date of RC.

- Registration instruments will be transferred via dispatch and post. The aspirants need not visit the Certificate of Registration of Procurement for MSTD services as well as the applicable certifying authority of digital hand with the downloadable format in the gate.

Rejection of the Operation

- Still, also the disfigurement memo will be issued ande-mail to the aspirant, If the operation is plant to be imperfect. The aspirant needs to amend the blights within 30 days.

- In case the aspirant rectifies the blights within 30 days, the officer will corroborate and if plant satisfactory also TIN will be generated. In this case the first operation of the date would be taken for the purpose of determining the effective date of the RC.

- If the aspirant doesn’t amend the blights shown in the disfigurement memo within 30 days, also the operation will be rejected and the temporary profile will be de-activated after 90 days.

Documents to be Furnished

- Still, also the details of the pan card attained from the Income Tax Department of the website will be accepted as evidence of Pan Card rather of dupe of Pan Card, If the pan Card isn’t available with the aspirant.

- Please relate Trade Indirect No 42 T of 2008 dated26.12.2008

- As evidence of place of business (POB and APOB) and hearthstone (POR) rearmost electricity bill is obligatory. Out of the remaining documents one can be submitted.

Documents to be uploaded only in case of PTRC are as follows:

| Sr No. | Acts | Document | Type |

| 1 | Documents Required for PTRC | Photograph | Uploading Documents to be optional |

| 2 | Documents Required for PTRC | Signature | Uploading Documents to be optional |

| 3 | Documents Required for PTRC | Scanned copy of PAN | Uploading Documents to be optional |

| 4 | Documents Required for PTRC | Address proof (Principle Place) of Employer | Uploading Documents to be optional |

| 5 | Documents Required for PTEC | No Documents Required |

Visited 733 Times, 3 Visits today