GST Rates in India

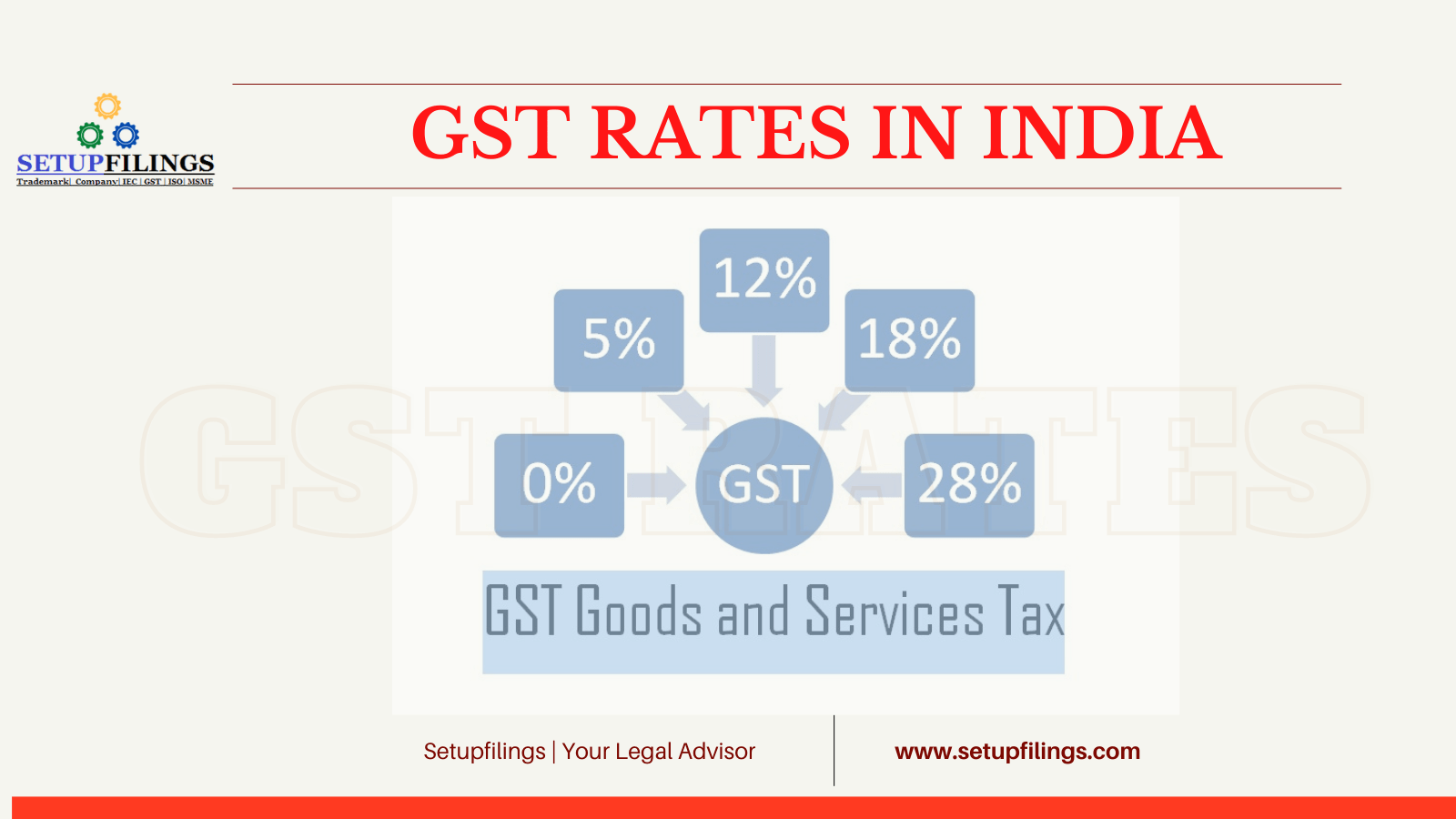

The GST rate sections are chosen by the GST Council. The GST Council changes the rate section of labor and products intermittently. The GST rates are normally high for extravagant supplies and low for fundamental necessities. In India GST rate for different labor and products is separated into four sections: they are 5% GST, 12% GST, 18% GST, and 28% GST.

The GST rates for different items have been changed a few times by the GST board since the beginning of the Goods and Services Tax (GST). The most recent rate correction was brought into impact in the 41st GST Council Meeting which was hung on Aug 27, 2020. Prior to that, there have been numerous GST Council Meetings where certain rate corrections were presented.

The details in respect to these rate revisions and other major things are being discussed below:

Revision of GST Rates announced in the 44th GST Council Meeting

GST rates on Covid-related essentials

|

Covid-related essentials |

Present GST rate |

Revised GST rate |

| Pulse oximeters | 12% | 5% |

| Hand sanitisers | 18% | 5% |

| Equipment to check body temperature | 18% | 5% |

| Furnaces for cremation and their installation | 18% | 5% |

| Ambulances | 28% | 12% |

GST rates on Covid medicines and tasting kits

|

Covid-related medicines and testing kits |

Present GST rate |

Revised GST rate |

| Testing kits | 12% | 5% |

| Specified inflammatory diagnostic kits | 12% | 5% |

GST rates on oxygen and oxygen-related medical devices

|

Oxygen and oxygen-related medical devices |

Present GST rate |

Revised GST rate |

| Medical grade oxygen | 12% | 5% |

| Oxygen concentrator or generator | 12% | 5% |

| Ventilators | 12% | 5% |

| Mak, canula, or helmet | 12% | 5% |

| BiPAP machine | 12% | 5% |

| High flow nasal canula device | 12% | 5% |

GST rates on Covid-related drugs

|

Covid-related drugs |

Present GST rate |

Revised GST rate |

| Tocilizumab | 5% | NIL |

| Amphotericin B | 5% | NIL |

| Heparin and other anti-coagulants | 12% | 5% |

| Remdesevir | 12% | 5% |

| Any other drugs recommended by ministry of health | NA | 5% |

Amendment of GST Rates reported in the 43rd GST Council Meeting

- GST on the commodity of help products to be absolved and will remain in actuality until 31 August 2021.

- GST on import of medication for dark parasite, that is Amphotericin B is likewise positioned under the exclusion list.

- Any Covid-related help thing whenever imported even determined to give to the public authority or any alleviation association will be absolved from IGST till 31 August 2021.

- Reprieve Scheme was declared by the money clergyman to diminish late expense returns. Little citizens can record returns under this plan.

- A gathering of priests will be shaped who will present a report by 8 June 2021 to decide if the rates are to be expanded or diminished.

Update of GST Rates declared in the 42nd GST Council Meeting

Features of the gathering hung on 5 October 2020

- Little citizens with a turnover of under Rs.5 crore can now document quarterly GSTR-3B and GSTR-1 where the due date for GSTR-1 will be the thirteenth day of the month succeeding the quarter. This new rule became effective on 1 January 2021. Because of the execution of this standard, the quantity of profits has decreased to 8 from 24.

- The quarterly citizens have the choice of paying 35% of the net expense obligation of the past quarter, utilizing an auto-produced challan for the initial two months of the quarter.

- For the auto-age of GSTR-3B, a guide is ready, where the subtleties of the provider’s GSTR-1 will help in auto-populating the ITC. GSTR-1 will help in auto-populating the expense risk also. Thus, it is essential to compulsorily record GSTR-1 preceding documenting GSTR-3B. This standard happened on 1 April 2021.

- Citizens will pay their GST through a basic challan.

- Citizens with a turnover of Rs.5 crore or more should make reference to a 6-digit HSN code. A 4-digit HSN code is to be referenced by citizens with a turnover of under Rs.5 crore. This standard happened on 1 April 2021.

- Applicants that have their PAN connected with Aadhaar will actually want to get discounts.

- ISRO, Antrix Corporation, and New Space India Limite (NSIL) will get GST exceptions to support the space sending off administrations in India.

- Sanitizers that are non-alcoholic will be kept on being charged at 18% GST.

- The remuneration cess gathered till date adds up to Rs.20,000 crore. This sum was dispensed to explicit states in India by 5 October 2020.

- 25,000 crore towards IGST 2017-18 was appropriated to explicit Indian states.

Features of the gathering hung on 12 October 2020

- The gathering finished with no unanimity on the issue of getting. The states might benefit of the choices recently gave to acquire reserves.

- The remuneration cess will be exacted will past the 5-year residency.

- The middle can’t get in the event of lack of remuneration cess reserve as it will make an expansion in the yield of G-sec securities.

- An acquiring schedule has been given where in the event that the getting goes past as far as possible, the G-Sec arrangements utilized as a benchmark for each and every other acquiring will increment.

- Cess gathered from July 2022 won’t be dispensed to states in India and will be utilized for the installment of head and interest. This will help in absolving the state from the weight of reimbursing the acquired sum.

Update of GST Rates reported in the 41st GST Council Meeting

The 41st GST Council meeting was led by the Union Finance Minister Nirmala Sitharaman and was hung on 27 August 2020. The public authority will give an extra 0.5% unwinding in states where as far as possible is under the FRBM Act. States can acquire more because of the injury that has been brought about by the Covid flare-up. Two choices have been given to the states to meet the remuneration cess setback.

Update of GST Rates reported in the 40th GST Council Meeting

The 40th GST Council meeting was led by the Union Finance Minister Nirmala Sitharaman and was hung on 12 June 2020. According to the gathering, no late expense will be imposed for citizens that go under nothing charge obligation. On the off chance that citizens document the profits between 1 July 2020 and 30 September 2020, the greatest late expense that can be charged is Rs.500. On account of little citizens (total turnover of up to Rs.5 crore), the pace of revenue has been decreased to 9% from 18% p.a. for GST returns that are petitioned for February, March, and April 2020. In any case, the profits should be documented before 30 September 2020.

Revision of GST Rates announced in the 39th GST Council Meeting

The following table reflects the changes in the rates applicable to the goods and services:

|

Goods or commodities |

New rate |

Old rate |

| Handmade matches | 12% | 5% |

| Mobile phones | 18% | 12% |

| Other handmade matches | 12% | 18% |

| Aircraft MRO services | 5% along with full ITC | 18% |

Announced on 14 March 2020, the rates mentioned above are applicable w.e.f. 1 April 2020.

Revision of GST Rates announced in the 38th GST Council Meeting

The following table reflects the changes in the rates applicable to the goods and services:

|

Goods or commodities |

New rate |

Old rate |

| Sacks of polythene and polypropylene | 18% | 12% |

| State owned lotteries | 28% | 12% |

| State authorised lotteries | 28% | 28% |

| Woven and non-woven fabrics | 18% | 12% |

Announced on 18 December 2019, the rates mentioned above are applicable w.e.f. 1 January 2020. Rates for the lotteries are applicable w.e.f. 1 March 2020.

Revision of GST Rates announced in the 37th GST Council Meeting

Announced on September 20th, 2019, the following table reflects the changes introduced in the rates applicable to the goods and services. These changes are applicable w.e.f. from 1 October 2019.

|

Goods or commodities |

New rate |

Old rate |

| Plates and cups made of tree products | Nil | 5% |

| Caffeinated Beverages | 28% + 12% cess | 18% |

| Supplies of Railways wagons & coaches (without the refund of accumulated ITC) | 12% | 5% |

| Outdoor Catering (without the ITC) | 5% | 18% |

| Diamond Job work | 1.50% | 5% |

| Other Job work | 12% | 18% |

| Hotels with Room Tariff of Rs.7501 and above | 18% | 28% |

| Hotels with Room Tariff from Rs 1,001 to Rs 7,500 | 12% | 18% |

| Woven or non-woven Polyethylene Packaging bags | 12% | 18% |

| Marine fuel | 5% | 18% |

| Almond Milk | 18% | – |

| Slide fasteners | 12% | 18% |

| Wet grinders (consisting of stone as a grinder) | 5% | 12% |

| Dried Tamarind | Nil | 5% |

| Semi-precious stones- cut & polished | 0.25% | 3% |

| Specified goods for petroleum operation under Hydrocarbon Exploration Licensing Policy | 5% | Applicable rate |

| Cess on Petrol Motor Vehicles (Capacity of 10-13 passengers) | 15% | 1% |

| Cess on Diesel Motor Vehicles (Capacity of 10-13 passengers) | 15% | 3% |

Revision of GST Rates announced in the 36th GST Council Meeting

The following table reflects the changes in the rates applicable to the goods and services:

|

Goods or commodities |

New rate |

Old rate |

| Electric chargers | 5% | 18% |

| Electric vehicles | 5% | 12% |

These rates were revised on July 27th, 2019 and is applicable w.e.f. August 1st, 2019.

Revision of GST Rates announced in the 31st GST Council Meeting

The following table reflects the changes in the rates applicable to the goods and services:

Goods or commodities |

New rate |

Old rate |

| Vegetables which are preserved provisionally but are not suitable for immediate consumption | 5% | Nil |

| Cooked or uncooked vegetables which are steamed, frozen or boiled (branded) | 5% | Nil |

| Music Books | 12% | Nil |

| Parts for manufacturing renewable energy devices falling under chapter 84, 85 or 94 of Tariff | – | 5% |

| Natural cork | 12% | 5% |

| Fly ash blocks | 12% | 5% |

| Walking sticks | 12% | 5% |

| Marble rubble | 18% | 5% |

| Agglomerated cork | 18% | 12% |

| Cork roughly squared or debugged | 18% | 12% |

| Articles of Natural cork | 18% | 12% |

| Movie Tickets worth Rs.100 or less | 18% | 12% |

| Premium on Third party insurance on Vehicles | 18% | 12% |

| Accessories for Handicapped Mobility Vehicles | 28% | 5% |

| Power banks | 28% | 18% |

| Movie Tickets worth more than Rs.100 | 28% | 18% |

| Video game consoles, equipments used for Billiards and Snooker and other sport related items of HSN code 9504 | 28% | 18% |

| Retreated & used pneumatic Rubber Tyres | 28% | 18% |

| Colour Television Sets & monitors up to “32 Inches” | 28% | 18% |

| Digital & Video Camera recorders | 28% | 18% |

| Pulleys, transmission shafts, cranks and gear boxes under HSN 8483 | 28% | 18% |

| Reduction of tax rates on Air travel of pilgrims | 28% | 18% |

Wares and Services GST rates

The GST Council has proposed a four-level duty structure wherein rates are either nothing or exceptionally low most definitely. The justification behind this is that these food things establish around half of the purchaser crate, and contributes fundamentally towards guaranteeing that inescapable expansion is held in line even after the overhauled charge chunks under GST have been carried out. Negative things and extravagance products, be that as it may, are relied upon to be charged at an impressively higher rate to keep up with income lack of bias for state and focal legislatures following the execution of the new GST rates. Other valuable metals are probably going to see the execution of an additional a concessional GST charge piece as these metals are right now charged at only 1% under VAT.

Following is a table of commodities and services and the GST rates applicable to them:

Commodities / Services |

GST Rate |

| Items that are not listed in any other category, such as electrical appliances, oil, soaps, etc. | 18% |

| All services like professional charges, fees, insurance, banking, restaurants, telecom, etc. | 18% |

| Essential farm produced mass consumption items such as wheat, rice, food grains, etc. | NIL |

| Mass consumption and common use food items like mustard oil, tea, spices, etc., but not including processed foods | 5% |

| Processed foods | 12% |

| Cars and white goods | 28% |

| De-merits and luxury goods and items that fall under the sin category, such as aerated drinks, tobacco, luxury cars, pan masala, etc. | 28% + CESS |

GST Council implements rate cuts leaving 35 goods in the highest tax bracket

By July 2018, the GST Council reduced tax rates on 191 goods, leaving only 35 items in the 28% tax category. Some of these include:

- AC

- Dishwashing machines

- Digital cameras

- Cement

- Video recorders

- Parts of automobiles

- Motor vehicles

- Tyres

- Yachts

- Aircrafts

- Aerated drinks

- Sin items such as tobacco, cigarette, and pan masala

FAQs on GST rates

- What is the GST rate for gold?

The GST on gold is 3% of its value. However, if the gold is converted into ornaments, an additional 5% GST is charged on the making charges. Thus, a total of 8% GST is charged on gold ornaments.

- What is the GST rate charged on mobile phones?

At present, the GST charged on mobile phones is 12%.

- What is the GST rate charged on two-wheelers?

At present, the GST charged on two-wheelers is 28%, which is the highest slab for GST. However, there have been petitions to reduce the GST on two-wheelers to 18%.

- What is the GST rate charged on television sets?

At present, the GST charged on television sets is 18% for TVs of up to 32 inches. For TVs that are bigger than 32 inches, the GST charged is 28%.

- What is the GST rate for lac?

The GST rate for lac is 3%.

- What is the GST rate for coffee?

The GST rate for coffee is 28%.

Visited 1238 Times, 1 Visit today