Company Registration Online – How to Register a Private Limited company in India

Company Registration Online Registering your company online under the right business structure is an important decision. Find out the prose and cons of different structures.

Picking the right company structure for your business is as important as any other business-related exertion. The right business structure will allow your enterprise to operate efficiently and meet your needed business targets. In India, every business must register itself as part of the obligatory legal compliance. Before we learn how to register a company, let’s pass and understand the types of business structures in India.

Relative List of Different Types of Business Structures in India

Then’s a relative list of the popular business structures in India.

| Company type | Ideal for | Tax advantages | Legal compliances |

| Limited Liability Partnership | Service-oriented businesses or businesses that have low investment needs | Benefit on depreciation | Business tax returns to be filed ROC returns to be filed |

| One Person Company | Sole owners looking to limit their liability | Tax holiday for first 3 years under Startup India Higher benefits on depreciation No tax on dividend distribution | Business returns to be filed Limited ROC compliance |

| Private Limited Company | Businesses that have a high turnover | Tax holiday for first 3 years under Startup India Higher benefits on depreciation | Business tax returns to be filed ROC returns to be filed An audit is mandatory |

| Public Limited Company | Businesses with a high turnover | Tax exemptions under | Business tax returns to be filed. Mandatory Audits |

What are the types of business structures in India?

Let’s pass and understand the types of business structures available in India. Then’s a list of some of them

One Person Company (OPC)

Lately introduced in the time 2013, an OPC is the stylish way to start a company if there exists only one protagonist or proprietor. It enables a sole- owner to carry on his work and still be part of the commercial frame.

Limited Liability Partnership (LLP)

A separate legal reality, in an LLP the arrears of mates are only limited only to their agreed donation. An LLP is a Registration under the Limited Liability Act, 2008 with the Registrar of Companies (ROC).

Private Limited Company (PLC)

A PLC in the eyes of the law is regarded as a separate legal reality from its authors It has shareholders (stakeholders) and directors ( company officers). Each existent is regarded as a hand of the company.

Public Limited Company

A Public Limited Company is a voluntary association of members which is incorporated under company law. It has a separate legal actuality and the liability of its members are limited to shares they hold.

You can choose what business structure suits your business needs stylish and consequently register your business.

Other forms of business structures include Sole procurement, Hindu Undivided Family, and Partnership enterprises. Please bear in mind, these structures don’t come under the dimension of company law.

Why is it important to choose the right business structure?

It’s important to choose your business structure precisely as your Income Duty Returns will depend on it. While registering your enterprise, remember that each business structure has different situations of compliances that need to be met with. For illustration, a sole owner has to file only an income duty return. Still, a company has to file an income duty return as well as periodic returns with the Registrar of Companies.

A company’s books of accounts are to be mandatorily checked every time. Abiding by these legal compliances requires spending plutocrat on adjudicators, accountants and duty form experts. Thus, it’s important to elect the right business structure when thinking of company registration. An entrepreneur must have a clear idea of the kind of legal compliances he/ she is willing to deal with.

While some business structures are fairly investor-friendly than others, investors will always prefer a recognised and legal business structure. For illustration, an investor may vacillate to give plutocrat to a sole owner. On the other hand, if a good business idea is backed by a recognised legal structure (like LLP, Company, etc) the investors will be more comfortable making an investment.

How to choose a business structure while applying for company registration in India?

Let’s take a look at some important questions every entrepreneur must ask himself before he/ she eventually decide upon a business structure.

How numerous possessors/ mates will your business have?

Still, a One Person Company would be ideal for you, If you’re a single person who owns the entire original investment needed for the business. On the other hand, if your business has two or further possessors and is laboriously seeking investment from other parties a Limited Liability Partnership (LLP) or Private Limited Company would suit you stylish.

Should your original investment determine your choice of business structure?

Still, it would be wise to go in for a Sole Proprietor, or HUF or Partnership Registration, If you want to spend lower originally. But, if you’re sure that you’ll be suitable to recover the setup and compliance costs, you can conclude for a One Person Company, LLP or a Private Limited Company

. Amenability to bear the entire liability of the business

Business structures like sole owner, HUF, and cooperation Registration have unlimited liability. This means, in case of any dereliction in loans, the entire plutocrat will be recovered from the members or mates in profit sharing rate. The threat to particular means is high in these cases.

Whereas, Companies and LLPs have a limited liability clause. This means that the liability of its members is confined to the quantum of donation made by them or the value of shares each member holds.

-

Income Duty Rates Applicable to businesses

The income duty rates applicable to a sole procurement and a HUF are the normal arbor rates. In the case of a Sole Proprietorship, the business income is conjoined with the existent’s other income. But in the case of other realities like cooperation Registration and company a duty rate of 30 is applicable.

-

Plans of getting plutocrat from investors

As mentioned before, it’s delicate to get investments when your business structure is unrecorded. Realities like LLP and Private Limited Company are trusted when it comes to investment. Make sure you choose the right structure, seek the help of an expert so that you register under proper guidance.

How to Register a Company in India?

Registering a company in India is now a simple 4-step process-

Step 1: Digital Hand Certificate (DSC)

As the registration process of the company is fully online, Digital autographs are needed to file the forms on the MCA gate. DSC is obligatory for all the proposed directors and the subscribers of the memorandum and papers of association.

Step 2: Director Identification Number (Noise)

The Director Identification Number ( Noise) is an identification number for a director and it has to be attained by anyone who wants to be a director in a company. The Noise of the proposed director along with the name and the address evidence is to be handed in the company registration form.

Step 3: Registration on the MCA Portal

To apply for company registration, the SPICe form is to be filled and submitted on the MCA gate. To fill the SPICe form and submit documents, the Director of the company has to register on the MCA gate. After registration, the director can log in and will gain access to the MCA portal services which include filinge-forms and viewing public documents.

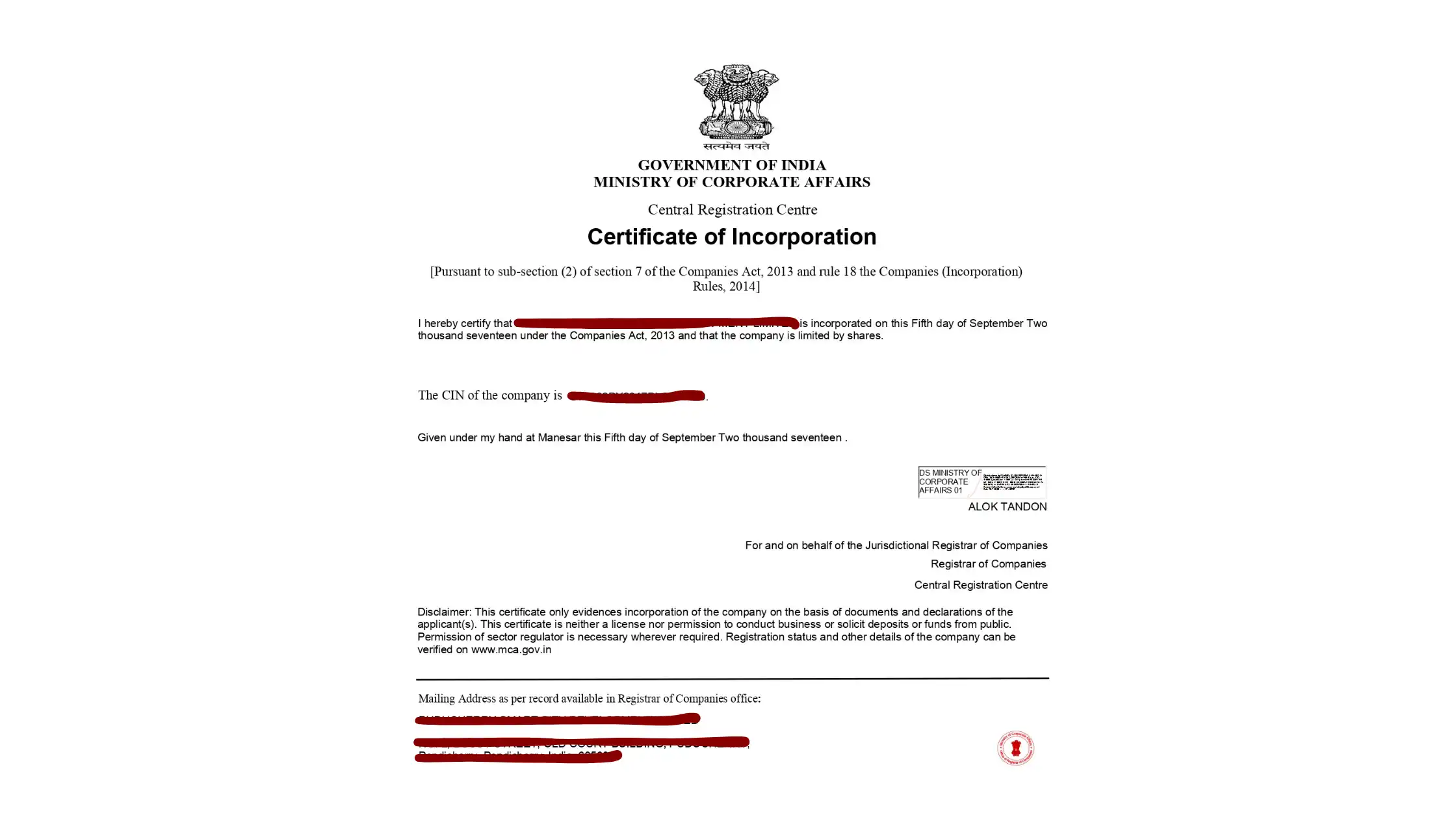

Step 4: Certificate of Incorporation

Formerly, the registration operation is filled and submitted along with the needed documents, the Registrar of Companies will examine the operation. Upon verification of the operation, he’ll issue the Certificate of Incorporation of the Company.

With this, we’ve covered the basics of how to register a company.

Documents needed for Company Registration?

The general documents that are to be submitted for registration of LLP, One Person Company, Private Limited and Public Limited Company are as follows:

. • Evidence of identification (Pan Card/ Aadhar card/ Driving license/ passport can be submitted as evidence of identity) of all the company’s directors and shareholders

- Evidence of address ( Rearmost Telephone Bill/ Electricity Bill/ Bank Account Statement) of all the company’s directors and shareholders

- Residency/ reimbursement agreement and letter or NOC from the landlord of his/ her authorization to use the office as the company’s listed office.

- Trade deed of the company demesne.

- Noise (DPIN in case of LLP) and DSC of all the directors ( mates in case of LLP).

For further details about documents needed for incorporating a private company, read our composition on documents needed for private limited company registration.

For further details about documents needed for incorporating a Public company, read our composition on documents needed for public limited company registration.

For further details about documents needed for incorporating an LLP, read our composition on documents needed for LLP registration.

What’s the Cost for Company Registration?

Plan quotation for OPC Registration – ₹ 7999 *

Plan quotation for LLP Registration – ₹ 9999 *

Plan quotation for PVT LTD Registration – ₹ 9999 *

* Prices shown above may vary. Please click then to communicate our experts for complete pricing details.

Benefits of Company Registration in India

A company registration provides numerous advantages. A licensed company makes it genuine and enhances the business’credibility.

- Protects against particular obligation, and defends against other pitfalls and losses.

- Builds goodwill and also supports further client magnet

- Gives dependable investors bank credits and good investment with ease.

- Provides cover of the responsibility to cover the company’s means

- Bigger commitment to wealth and lesser stability

- Increases the capability to develop and grow large

For a detailed understanding about the advantages of carrying a company registration, read our composition on the Advantages of Company Incorporation.

Name and Capital of the Company

- Selection of Company Name

The name of the company should be proposed in the Form SPICe 32 operation. Only one favored name along with the significance of keeping that name can be given in the Form SPICe 32 operation.

The type of reality and one proposed name for the company is to be entered for reserving the name of the company. The proposed name shouldn’t be analogous to the being name of any company or LLP or Trademark. However, another name can be submitted by applying another Form SPICe 32 operation and paying the prescribed freights, If the name gets rejected.

An OPC should have the name in the form of “ XYC (OPC) Private Limited”. Also, a private company should have the name in the form of “ XYZPvt.Ltd.” and a public company name in the form of “ XYZ Limited”.

Capital of the company

There’s no demand of minimal paid-up capital to start a private limited company or a one-person company. Still, the public limited company must have a minimal paid-up capital of Rs. 5 lakh.

The paid-up capital means the quantum of plutocrat a company has entered from shareholders in exchange for shares of the company. It’s created when a company sells its shares in the request directly to investors, generally through an Original Public Offering (IPO).

The authorised capital of any company must beRs. 1 lakh. The authorised capital means the maximum quantum of share capital that the company is authorised by its Memorandum of Association to issue to its shareholders. The authorised capital must be mentioned in the MoA.

Compliances to be followed by the Company

Formerly, the company is registered there are certain compliances to be followed by the company annually. The company needs to follow compliances similar as the Company is needed to appoint its first adjudicator within 30 days of objectification In the first board meeting. Every company must conduct minimum of 4 board meetings during the timetable time at quested intervals.

It has to maintain and train of profit and loss account, periodic return and balance distance every fiscal time together with an adjudicator’s report before the due date with the Registrar of Companies. Every company is needed to maintain certain Statutory Registers.

For further details about compliances to be followed by the company, read our composition on Compliances under the Companies Act 2013.

The company needs to file certain periodic forms with the Registrar of Companies. Details of all forms along with the due date of filing these forms are given in our composition ROC Compliance Timetable.

Constantly Asked Questions on Company Registration

Where can I register my company?

Still, you must submit an operation to the Ministry of Corporate Affairs (MCA), If you intend to register a new company in India. You make the operation online at the MCA portal ever too. For registration, you ’ll need a Digital Hand Certificate (DSC), and Director Identity Number ( Noise), among other effects.

What happens if my company name is formerly taken?

The Ministry of Corporate Affairs (MCA) that maintains a record of registered company names, you ’ll have to pierce that directory and check if your company name is formerlyregistered.However, you ’ll have to choose another name, If the company name appears in the company registrationdirectory.However, you ’ll have to make another operation for a different name that’s preliminarily not registered, If you have formerly made an operation.

Can a foreign public be a director of a company?

Yes, as per the Indian company law, a foreign public can be a director of a company registered in India. Still, he must fulfil all the criteria laid down in the Act. The most important being allotment of a Director Identification Number .

Any person, including a foreign public, appointed as a Director can not act in the capacity of a Director unless he/ she gives it formally in jotting. This can be done by filing Form DIR-2 within 30 days of being appointed as the director.

How numerous days does it take to register a company?

The new changes brought about by the MCA have made it easy to register companies of any nature with the government. Handed that you have all your documents in place, it can take anywhere between 10 – 15 days to register your company formally.

Is a physical presence of a person demanded for company registration?

The entire process is completed online, so you do n’t have to be present at any particular place for registration. A scrutinized dupe of the documents must be submitted via correspondence. At the business address, they admit the company objectification instrument from the MCA.

How do I check if my company is registered or not?

You can check the status of the company registration on the MCA website. To check the status of your company, you need to go to the‘MCA Services’ tab and elect the‘View Company/ LLP Master Data’from the drop-down list. Also enter the company’s CIN and click‘ Submit’. The exact status of your company will be displayed.

Is the company registration process fully online in India?

Yes, the company registration is fully online. A company or an LLP can be registered only through the MCA gate. The scrutinized documents of the company/ LLP are transferred by correspondence to the MCA and they’re reused at the Central Registration Centre (CRC) which acts as a devoted back office for Company and LLP Registration process. Upon completion of registration, the company/ LLP receives a digitally inked Certificate of Incorporation which can be vindicated by all the stakeholders on the MCA website.

Visited 413 Times, 1 Visit today