UAN Activation Made Easy: Everything You Need to Know

Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 requires enterprises with 20 or more employees to register with the Employee Provident Fund Organisation (EPFO). Employees are expected to contribute a minimum of 12% of their basic earnings to the Employee Provident Fund (EPF) plan. The company is likewise expected to contribute an equivalent amount to the employee’s account, not to exceed 12%.

The Universal Account identifier (UAN) is a twelve-digit identifier provided to each EPFO member that allows them to acquire and manage information about their EPF account.

Required Documents for UAN Activation

Documents necessary for UAN Activation and authentication include:

- Bank account details: such as the IFSC code, account number, and branch name.

- The PAN Card: Your PAN must be linked to your UAN.

- Aadhaar Card: Aadhaar card is required Bocos your mobile number and account number are linked to your Aadhaar number, you must present it in order to activate UAN online.

- Any additional identification or proof of residency that may be required.

UAN creation using the UAN Portal

UAN creation using the UAN Portal

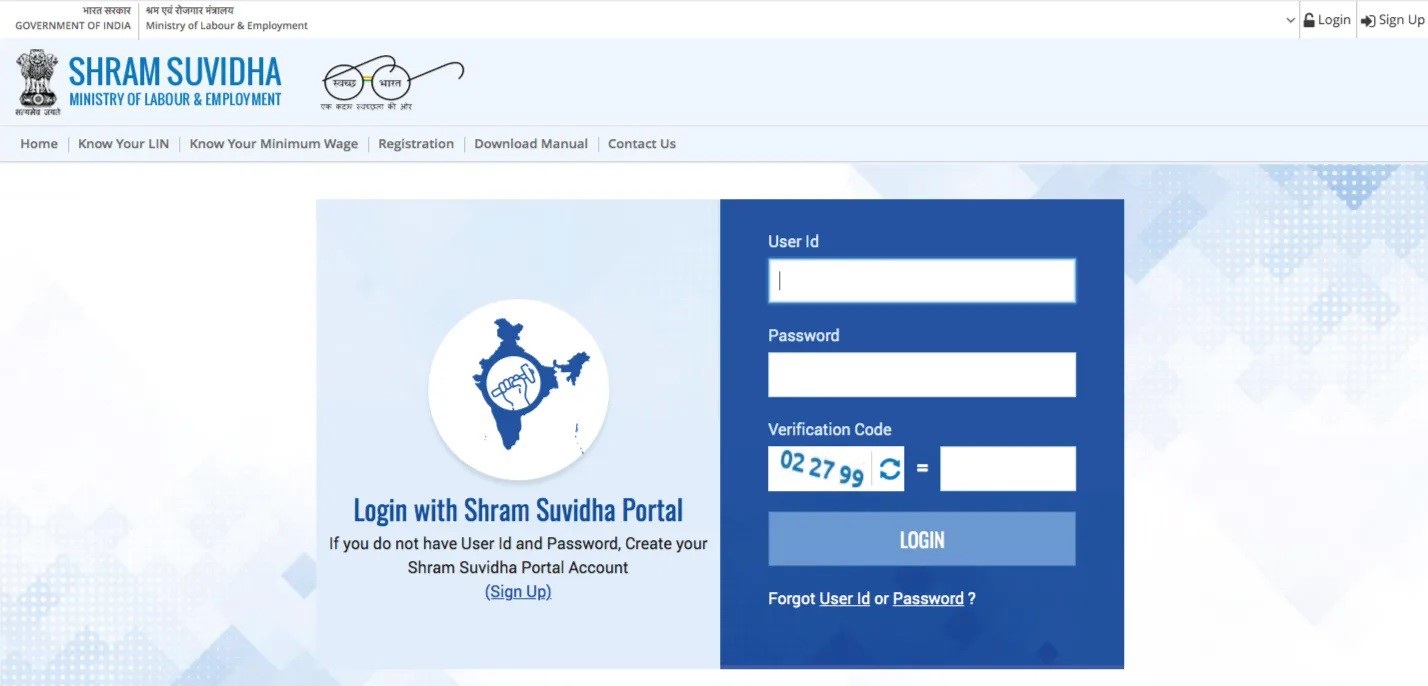

At the time of first registration to the EPF Scheme by the employer, EPFO issues each employee a unique UAN. If the employer has registered the establishment using the Shram Suvidha site, it may be done swiftly through the EPFO employer site. The following actions must be taken by the employer in order to register an employee for UAN

- Visit Government of India EPFO Homepage

- Log in to the establishment using your establishment ID and password.

- In the “Member” area, click the “Register Individual” link.

- Enter the employee’s information, such as PAN, Aadhaar, and account number information.

- In the “Approval” section, approve all information.

For the employee, a new UAN will be established, which can be readily linked to the PF account. To minimise duplication, the employer must ensure that legitimate papers such as identification proof, address proof, bank data, and Permanent Account Number (PAN) are acquired during employee onboarding, both in soft copy and hard copy for future reference. If an employee already has a UAN, they only need to inform their new employer of their current UAN.

It is the employer’s responsibility to advise employees of their UAN number. However, if they do not, an employee can receive their UAN via the EPFO site using their Member ID, PAN, and Adhaar by following the procedures below:

- Visit Member Home

- Select the “Know Your UAN Status” option.

- Enter the necessary information (PAN, Aadhar, or Member ID).

- Select “Get Authorization Pin” to receive an OTP to your registered cell phone number.

- Enter the OTP to receive an SMS with the UAN and its status.

Activation of UANs via the UAN Portal

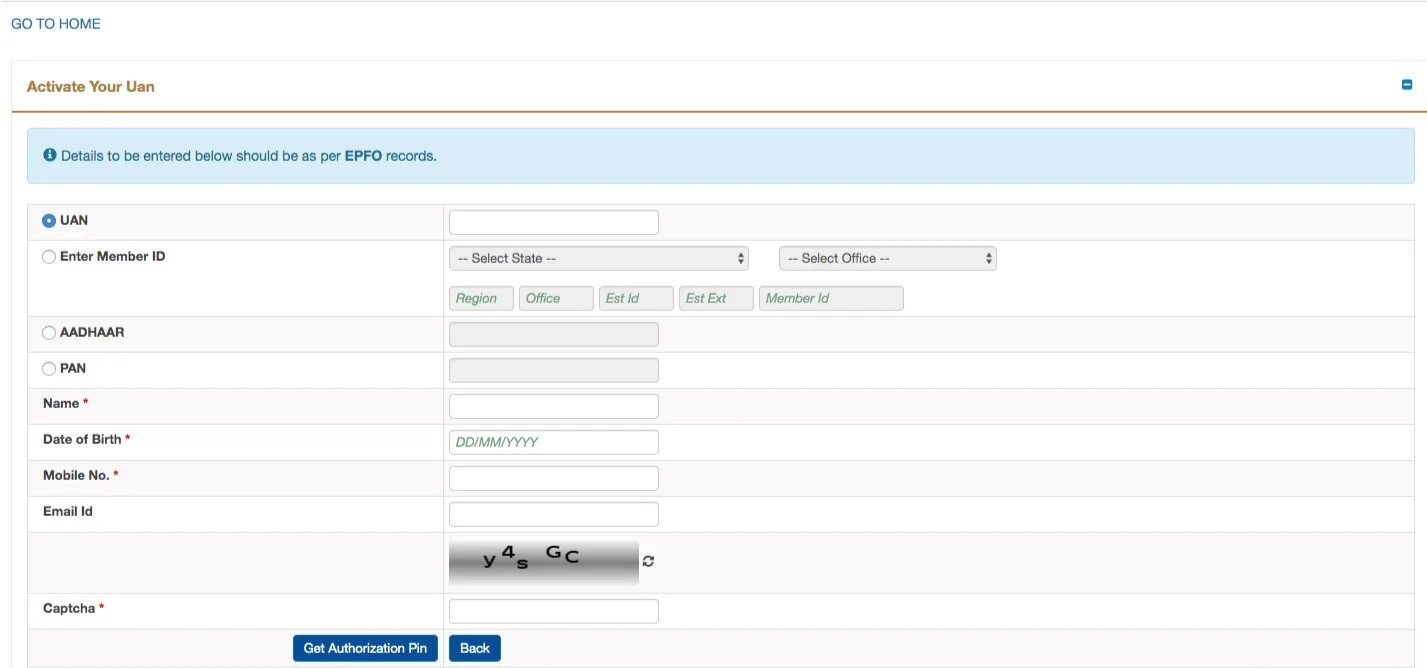

An employee can activate their UAN via the UAN portal by completing the procedures outlined below:

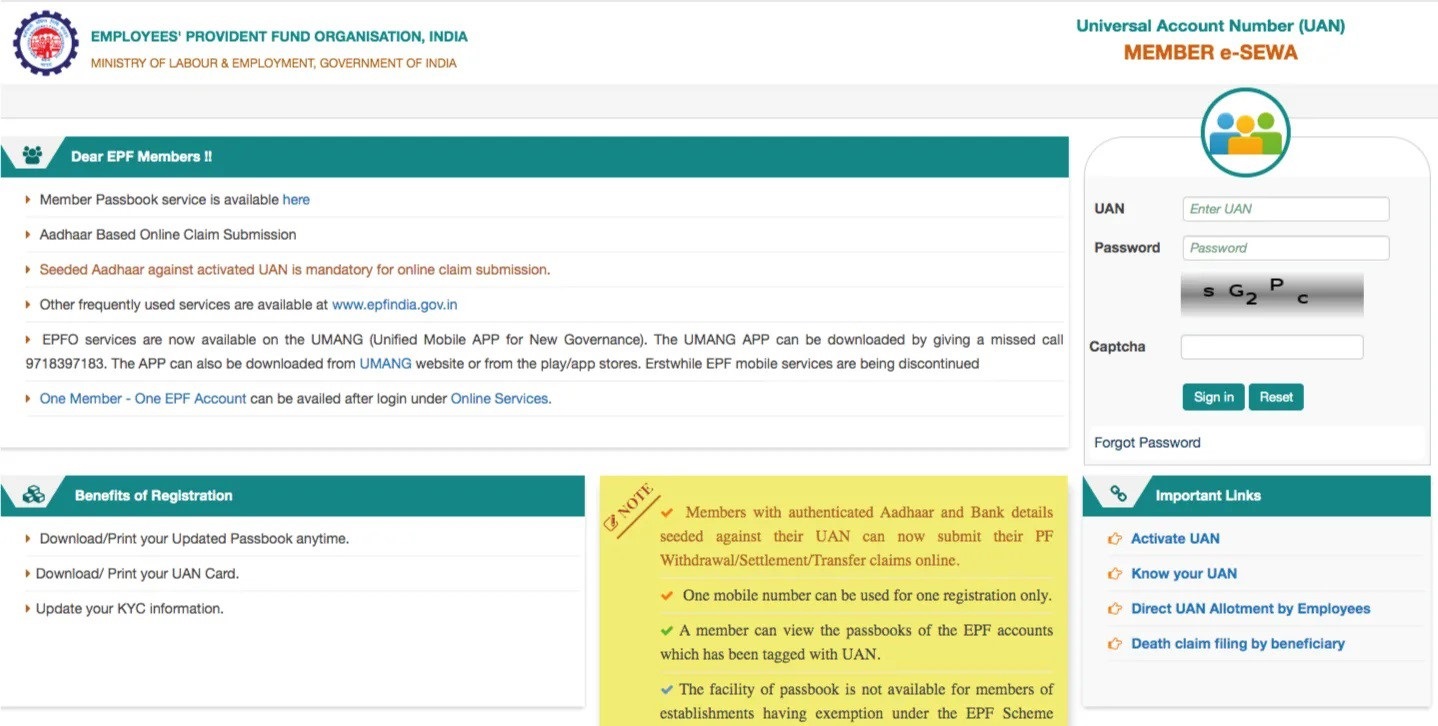

- Go to the UAN eSewa site.

- 2. Click on the “Activate UAN” option.

- Enter the necessary information (PAN, Aadhar, or Member ID).

- Select “Get Authorization Pin” to receive an OTP to the registered mobile phone number.

- Enter OTP received on email Id and Mobile Number and click on Activate UAN to activate UAN.

After completing the Entire UAN activation online procedure, the member will receive a password on their registered Email Id and mobile number, which they change if required in future.

A member can use the EPF passbook service by logging in to MEMBER e- SEWA with their UAN as their user id and password. The UAN passbook service allows members to manage and track their EPF balance from the convenience of their own home.

Online technique for linking Aadhaar to UAN:

- Go to the Member’s Residence

- Log in to MEMBER e-SEWA with your UAN and password.

- Choose “KYC” from the “Manage” menu.

- Select the “‘Aadhaar'” option.

- Enter the necessary information (name and Aadhaar Number).

- Press the “Save” button.

When the “verified” status appears next to the Aadhaar number, the Aadhaar connection procedure is complete.

Offline method

The offline method of connecting Aadhaar to UAN is to visit any EPFO branch or Aadhaar CSE (Common Service Centre). There, the member must fill out a request form and provide a self-attested copy of their Aadhaar card. It will be completed after verification, which will be verified by a notification to the registered cell phone number.

Since its establishment in 1952, EPFO has gone a long way. It has made several key steps along the road, from offering a social security service to making EPF claim settlement quicker, and UAN is one of them.

7 Important Characteristics of a Universal Account Number (UAN)

The EPF Serves UAN Number as a unique identity for all EPF Account holders, allowing them to easily access their account check EPF balance and track their EPF contributions status timely, same number can also be used for withdrawals, and transfer requests. The following are the most notable benefits of employing UAN are has follow below.

Single Point Access: Members may access their EPF account through a single point of contact, eliminating the need to know several account numbers.

Convenient smartphone Access: Members may see their EPF account data from anywhere, at any time, using the UAN Member Portal’s smartphone application.

Passbook updated: EPF Members can check their transaction history in detail via. UAN Member Portal’s passbook access.

E-Nomination: Using the UAN portal, EPF members can nominate someone to receive their EPF balance on their behalf in the case of their death.

Transferring EPF accounts: from one organisation to another is simplified using UAN, eliminating the requirement for physical form submissions.

Real-time Claim Status: Members can use the UAN Member Portal to monitor the status of their EPF withdrawals, transfers, and other claims.

Transaction SMS notifications: The UAN Portal delivers transaction SMS notifications for donations, withdrawals, and other transactions, keeping members informed and up to date.

These UAN capabilities make handling EPF accounts simple and effective for members.

The Top 7 Advantages of Using a Universal Account Number (UAN)

The Employees Provident Fund (EPF) Universal Account Number (UAN) is a ground breaking technology that provides a plethora of benefits to its members. Here are some of the most significant advantages of utilising UAN:

Members may access all of their EPF information from a one location, removing the need-to-know different account numbers.

On the Go: Mobile Application have been launched for EPF member to access their account anywhere and anytime.

Transparency: Members get quick access to their passbook via the UAN Member Portal, offering a transparent picture of all EPF transactions.

Peace of Mind: UAN members can choose a beneficiary for their EPF account, guaranteeing that their funds are distributed to their selected beneficiary in the case of their death.

Transfers Are Simple: Thanks to UAN, members may easily move their EPF accounts from one organisation to another.

Real-Time progress: The UAN Member Portal allows members to verify the progress of their EPF withdrawal, transfer, and other claims in real time.

Notification: UAN delivers SMS alerts for different transactions, including as donations and withdrawals, so members are constantly up to date.

What is the Important of a UAN Number (Universal Account Number)?

A Universal Account Number (UAN) for the Employees Provident Fund (EPF) is required for a variety of reasons. Here are a few of the most important:

Easy Access: The EPF Member can easily access to their RPF Account through Mobile Application of Web based portal.

Smooth Transfers: With a UAN, transferring your EPF account from one firm to another is simple, with no need for paper forms.

Everywhere & Anywhere: UAN platform allows EPF Member to manage your EPF account from All the location in world.

Simple Recording system: UAN Member Portal allows EPF Member to check the entries in their EPF passbook account in systematic manner on monthly basis.

Simple Contributions: UAN makes it simple to contribute to your EPF account online, saving you time and effort.

How Do I Locate/Verify My UAN Number?

The UAN (Universal Account Number) is a unique 10 digit identifying number assigned to employees by the Employee Provident Fund Organisation (EPFO). It is a necessary component for accessing employee provident fund (EPF) accounts, and having an active UAN is required to take advantage of different EPF advantages.

You may find your UAN by visiting the EPFO site or checking your pay stub or provident fund statement. To get your UAN, go to the EPFO site and click on the ‘Know Your UAN Status’ option, then input your basic information such as your name, date of birth, and cell phone number. You can also generate your UAN number online via the EPFO portal by following a few simple steps.

Frequently Asked Questions for UAN Activation

1. Can you reactivate your UAN if you change jobs?

Answer: Because UAN is a one-time use identification number, it does not need to be activated again when you change employment.

2. Why is it necessary to include all prior member IDs in the Universal Account Number?

Answer: A Universal Account Number is used to aggregate all Member Identification Numbers assigned to an individual employee. This consolidates information about all of the schemes to which an employer has contributed on behalf of an employee, making it easier for the employee to see all of his/her accounts.

Employees would be required to reveal their former Member ID or UAN on Form-11 under the proposed amendments.

3. Can contract employees register for the UAN and use online services?

Answer: Employers with 20 or more permanent workers must establish Universal Account Numbers for employees earning $15,000 or more per month beginning on the sixth of the following month. Furthermore, when their employers have authorised the account number, both full-time and contract employees can sign up for UAN online.

4. Is the UAN registration application free of charge?

Answer: By using EPF Official website, EPF Member can activate their UAN Number free of cost, and there are no government fees.

5. Is the UAN assigned by the employer or by a government agency?

Answer: When an employee enrols in the EPF, the Employees’ Provident Fund Organisation (EPFO) assigns him or her a Universal Account Number (UAN).

6. Can you use your UAN to transfer payments even if you haven’t linked it to Aadhaar?

Answer: You will be unable to transfer cash or withdraw pension funds unless your Aadhaar number is connected to your UAN. You must use your UAN to seed your Aadhaar number.

7. Is UAN required for any online claims?

Answer: A valid UAN is required for any online claims related to PF or pension.

8. Is it feasible to obtain more than one UAN?

Answer: Each individual is given only one UAN. It can be utilised by the employee when they are employed by another qualified employer.

9. Is the PAN and UAN connected for an employee who is a PF subscriber?

Answer: Yes, UAN must be connected to PAN by default. Furthermore, a subscriber must guarantee that Aadhaar is connected.

10. Can employers withhold employee provident fund (EPF) balances when firing or ending a contract?

Answer: No, because EPF accounts are tied to UANs, which are transferable between eligible and registered employers, this is not possible.

11. What is the difference between a PF account number and a universal account number?

Answer: A PF number is necessary for EPF withdrawals. This includes all PF information as well as facts on the impacted employee’s transactions with the organisation.

UAN is an abbreviation for Universal Account Number. The UAN contains information on all of an employee’s Member Ids. A UAN is valid for the duration of an employee’s employment and is a permanent number. If an employee changes employment, the UAN remains the same.

12. Can an employee be issued more than one UAN under a same name?

Answer: Employees can only have one User Account Number (UAN) associated with their name. It can be used at any qualifying workplace.

13. Can UAN be enabled by a mobile app or SMS?

At the moment, you cannot activate your UAN through SMS. Currently, the only way to activate is to register online on the EPFO Portal or through the Umang app.

14. Can personal information for UAN be updated? What exactly is the procedure?

Answer: Employees will get an appreciation message with a unique verification code to input after changing their information in the universal account number site.

15. Is it possible to activate a UAN while offline?

Answer: Employees must register for a UAN, or universal account number, in order to use EPFO’s online services. This can only be done online.

Employees must supply their employers with up-to-date employment information, which employers must validate and report to the appropriate officials. The information will be available in the UAN site after confirmation.

Visited 86 Times, 1 Visit today